Reconcile with Unreconciled difference of negative amount

This will guide you through the process of reconciling an account even if there is Unreconciled Difference of negative amount. This case may mean there is a check, payment or debit transaction that was recorded by the bank (since it is shown in the bank statement) but was not recorded in the company’s record. Example would be bank service charge where the bank decreases the company’s bank account balance without informing the company of the amount.

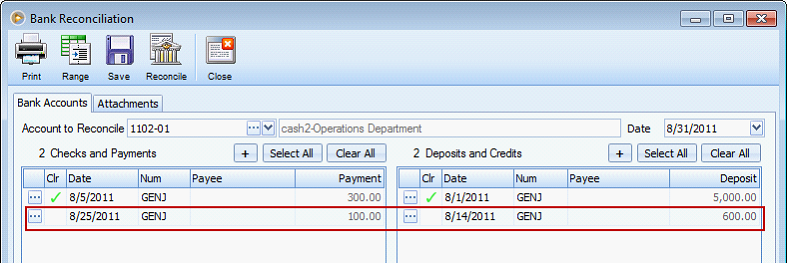

1. Enter the Ending Balance appearing on your bank statement in the Statement Ending Balance field at the bottom of this form.

2. Go over your bank statement and check the transaction in the Bank Reconciliation form that match it.

Let us assume that there are transactions shown in the Company’s record that are not recorded in the bank statement (see transactions that are not checked in the screenshot that follows)

and there is also transaction appearing on your Bank Statement that does not appear on your Company’s record (this is the amount shown in the Unreconciled Difference field).

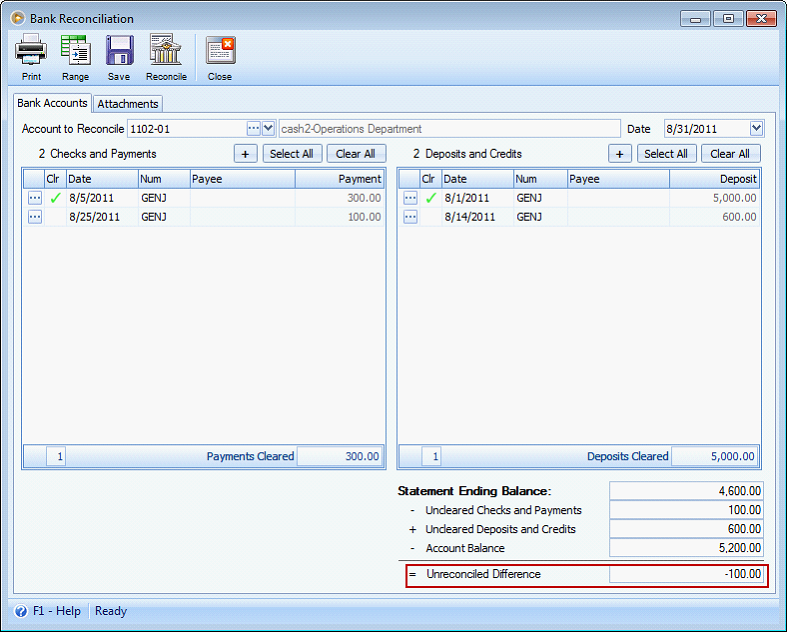

Notice these fields are updated after entering Statement Ending Balance:

•Uncleared Checks and Payments field - will show all check and payment transactions that are not selected/checked.

•Uncleared Deposits and Credits field - will show all deposit and credit transactions that are not selected/checked.

•Unreconciled Difference field - will show the Total amount after computing the fields before it. The formula being used to compute for the Unreconciled Difference is shown clearly before each field caption. For this illustration, the formula is shown below.

Statement Ending Balance - Uncleared Checks and Payments + Uncleared Deposits and Credits - Account Balance = Unreconciled Difference

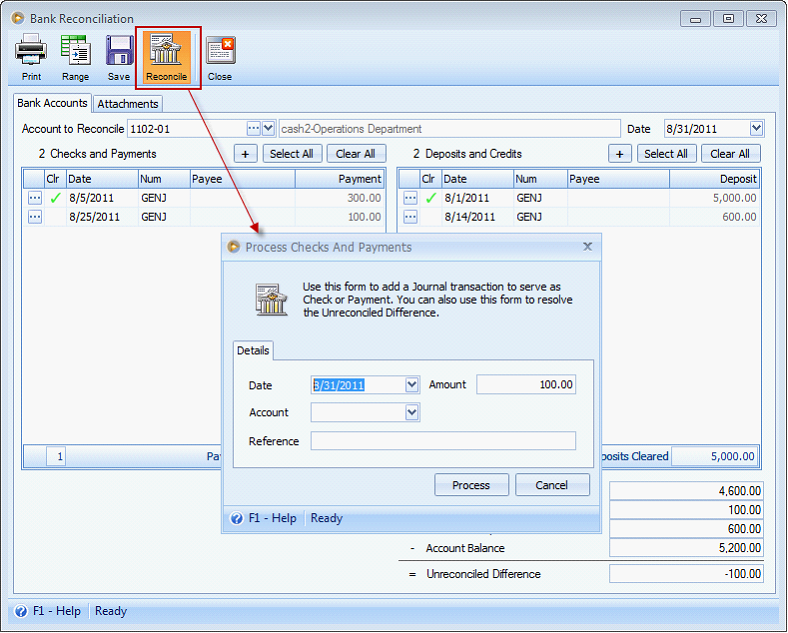

3.Click Reconcile button and the Process Checks and Payments form will open.

![]() Take note that when there is a negative Unreconciled Difference, this form will be shown. This is to automatically record a check or payment transaction equal to that of the Unreconciled Difference amount.

Take note that when there is a negative Unreconciled Difference, this form will be shown. This is to automatically record a check or payment transaction equal to that of the Unreconciled Difference amount.

Enter the Date of when you want to record that transaction, can be the date appearing on your statement to match your bank statement or can be the date when you entered it, in this case during reconciliation – 8/31/2011.

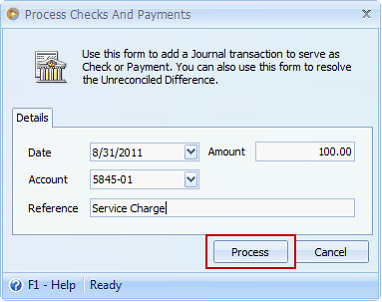

Complete other information like contra account for the cash account in the Account field and Reference field. Then click Process button.

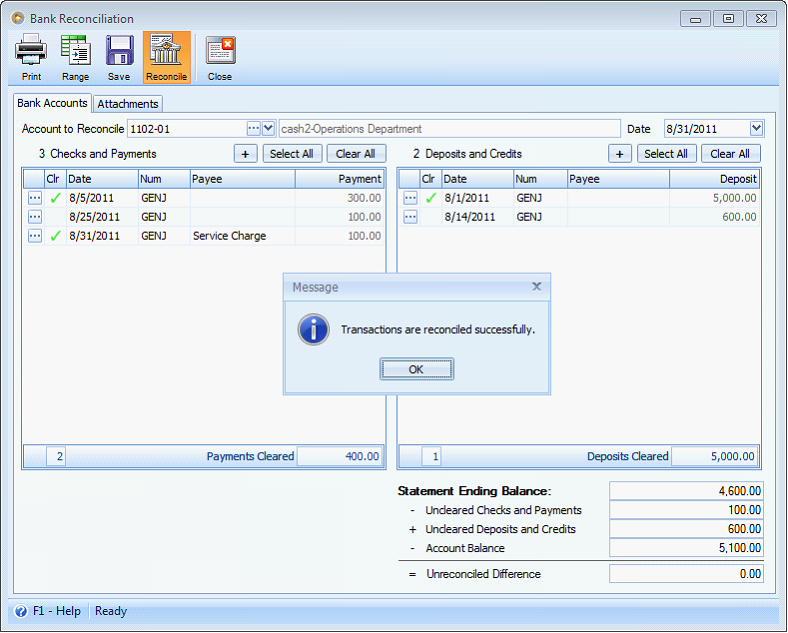

A confirmation of the success of reconciliation will be shown. Click OK button.

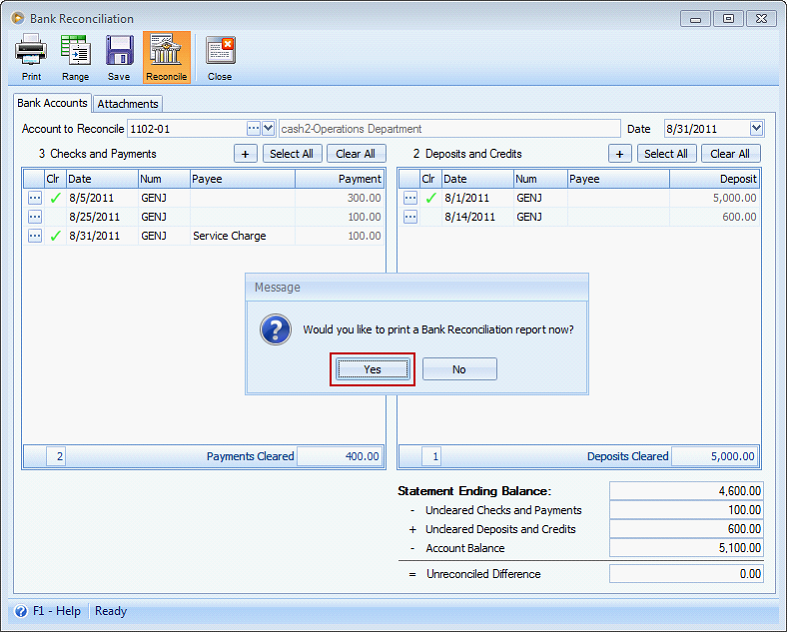

Another message will be shown. Click Yes if you would like to print a Bank Reconciliation report.

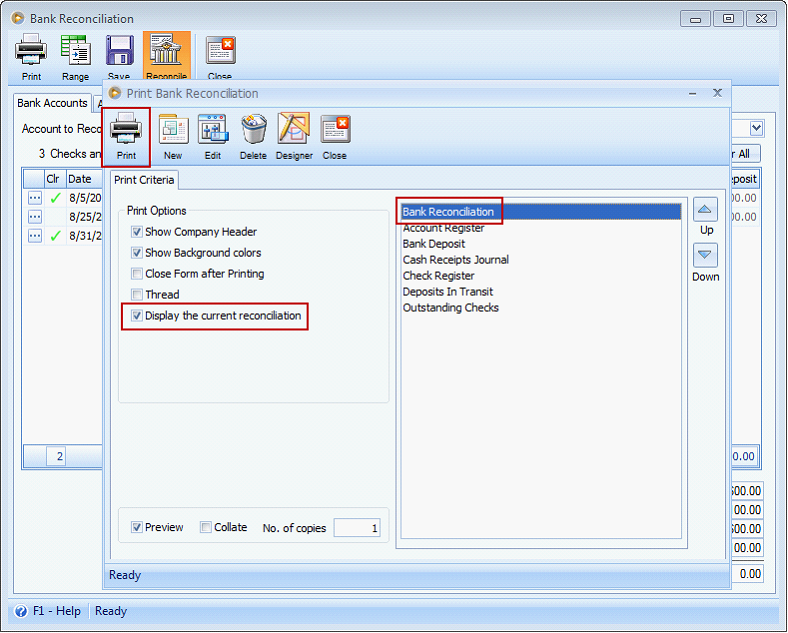

4. The Print Bank Reconciliation form will be shown. In here, you will see the Display the current reconciliation is checked by default. Once this option is checked, this will only print the reconciliation you just made.

Click Print button.

This is how the Bank Reconciliation report be like.

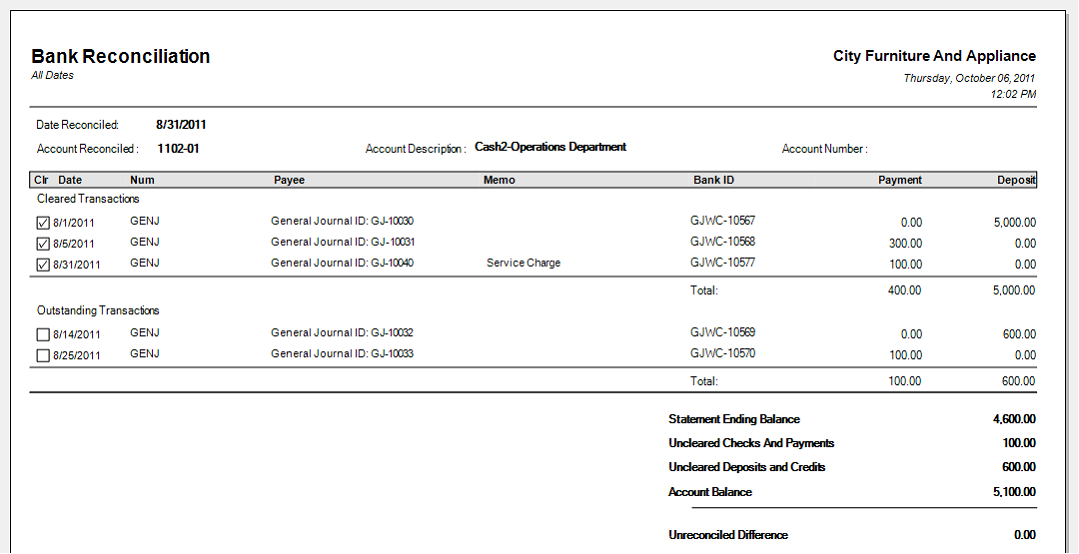

Each information on this report is described below.

•Date Reconciled will show the date of reconciliation.

![]() Cleared Transactions will be shown in the first section of the report. Also you will see in this section the bank service charge transaction that was not recorded in the company’s record but is appearing on the bank statement. This is also the -100.00 appearing on the Unreconciled Difference field when we did the reconciliation.

Cleared Transactions will be shown in the first section of the report. Also you will see in this section the bank service charge transaction that was not recorded in the company’s record but is appearing on the bank statement. This is also the -100.00 appearing on the Unreconciled Difference field when we did the reconciliation.

![]() Outstanding Transactions section will show all transactions not selected/cleared but are present in the Bank Reconciliation form when we did the reconciliation.

Outstanding Transactions section will show all transactions not selected/cleared but are present in the Bank Reconciliation form when we did the reconciliation.

![]() Statement Ending Balance will show the amount you entered that is the same amount shown in your Bank Statement.

Statement Ending Balance will show the amount you entered that is the same amount shown in your Bank Statement.

![]() Uncleared Checks and Payments will show the Total Checks and Payments under Outstanding Transactions section.

Uncleared Checks and Payments will show the Total Checks and Payments under Outstanding Transactions section.

![]() Uncleared Deposits and Credits will show the Total Deposits and Credits under Outstanding Transactions section.

Uncleared Deposits and Credits will show the Total Deposits and Credits under Outstanding Transactions section.

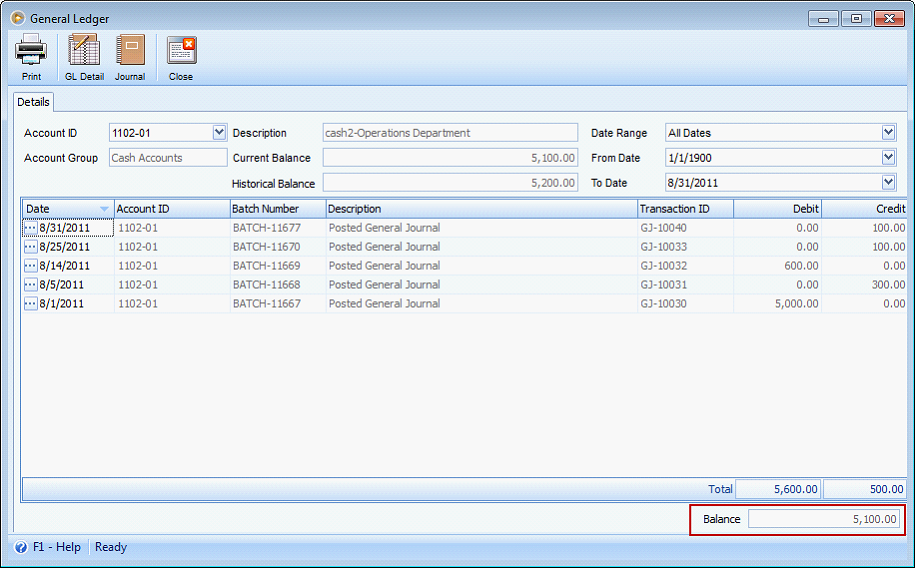

![]() Account Balance is the same amount appearing in the General Ledger form > Balance field using a filtered date equal to As of ‘date of reconciled’. In this example, As of 8/31/2011.

Account Balance is the same amount appearing in the General Ledger form > Balance field using a filtered date equal to As of ‘date of reconciled’. In this example, As of 8/31/2011.

![]() Unreconciled Difference at this point will show 0.00 since we have already created the transaction for the out of balance.

Unreconciled Difference at this point will show 0.00 since we have already created the transaction for the out of balance.

![]() Note that it is only in Bank Reconciliation form where you can reconcile or mark a transaction as cleared. The previous way of doing it in Bank Register form, i.e. checking the Clr checkbox to manually reconcile it without undergoing the process of reconciliation in the Bank Reconciliation form had been removed to managed the Ending balance properly based on the date when it was reconciled.

Note that it is only in Bank Reconciliation form where you can reconcile or mark a transaction as cleared. The previous way of doing it in Bank Register form, i.e. checking the Clr checkbox to manually reconcile it without undergoing the process of reconciliation in the Bank Reconciliation form had been removed to managed the Ending balance properly based on the date when it was reconciled.