Posting Tips in Payroll

As per 941 instructions, Tips received by the employees are taxable. These tips can be given to the employee on a daily basis directly from the cash register or can be collected as part of the employees’ paycheck. On both scenarios, tips should be shown as part of the paycheck.

Tips on a daily basis

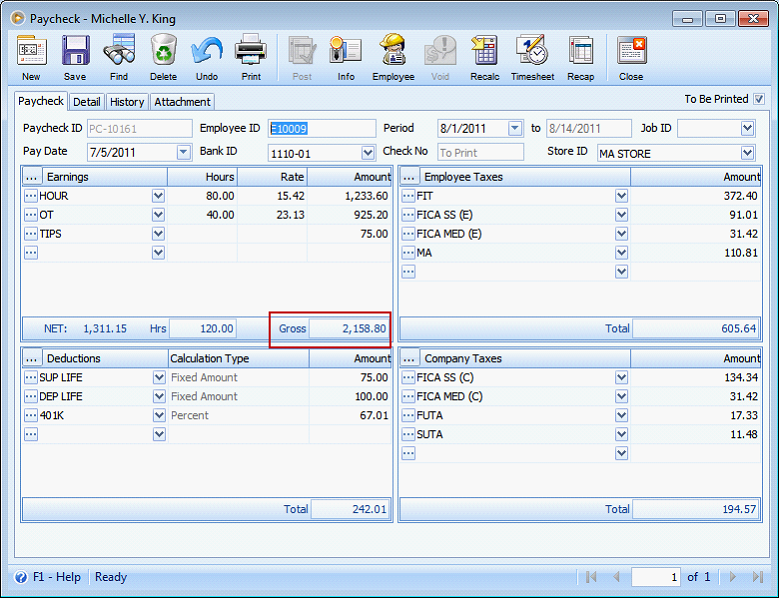

Tips received on a daily basis is still displayed on the paycheck however, it is not included in the Gross Pay because the employee already received the amount beforehand. The system only deducts the taxes associated on the tips from the Gross Pay.

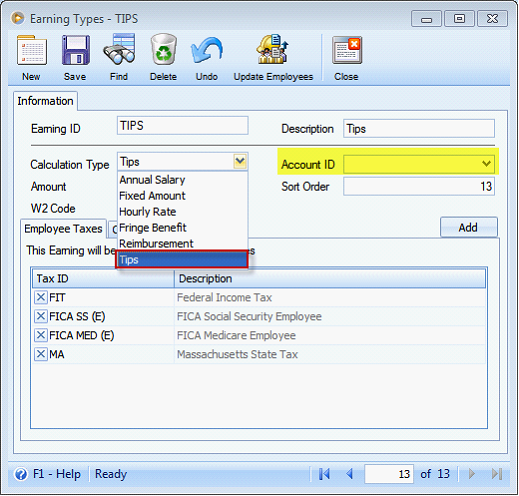

To cater this scenario, Tips is added as Calculation Type on Payroll > Earnings Type. Once it is selected, Account ID field will be disabled.

If used on a paycheck, it will not be included on the Gross Pay but the taxes associated on the Tips will be deducted.

Since amount here is already received beforehand, there is no G/L entry created for tips.

Tips as part of the paycheck

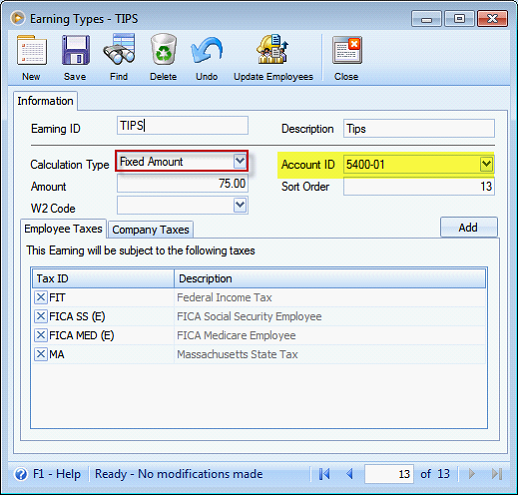

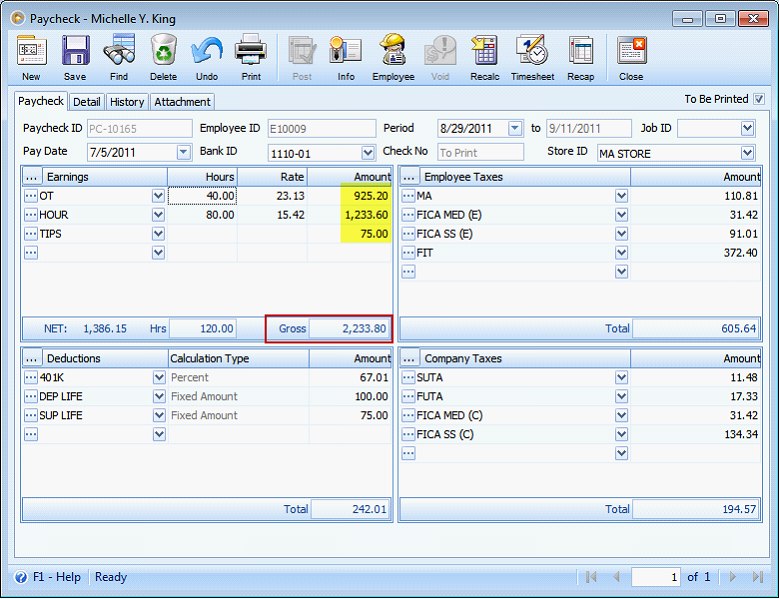

If tip was given as part of the paycheck, it works like a usual earning. A Fixed Amount earning should be used to display tips on paycheck form.

Once it is used on paycheck, it will be included in the Gross Pay and associated taxes will be deducted.

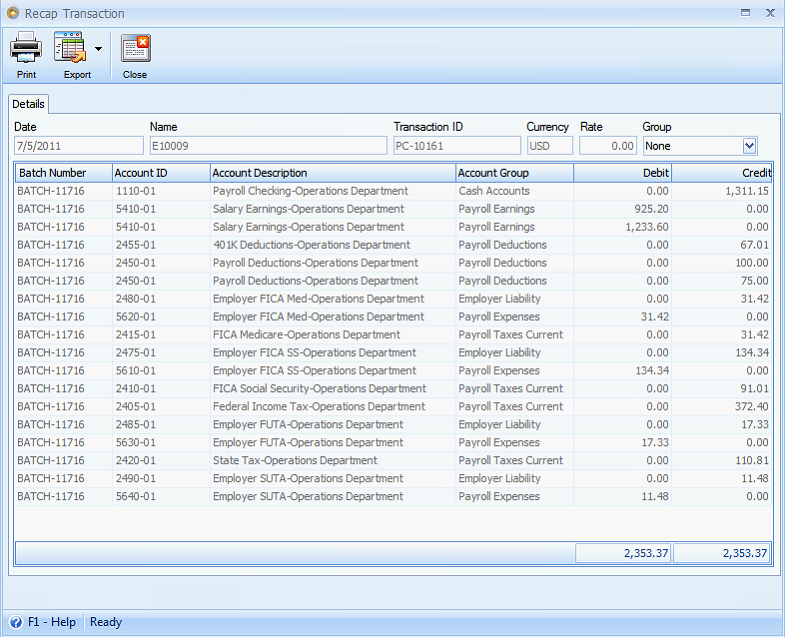

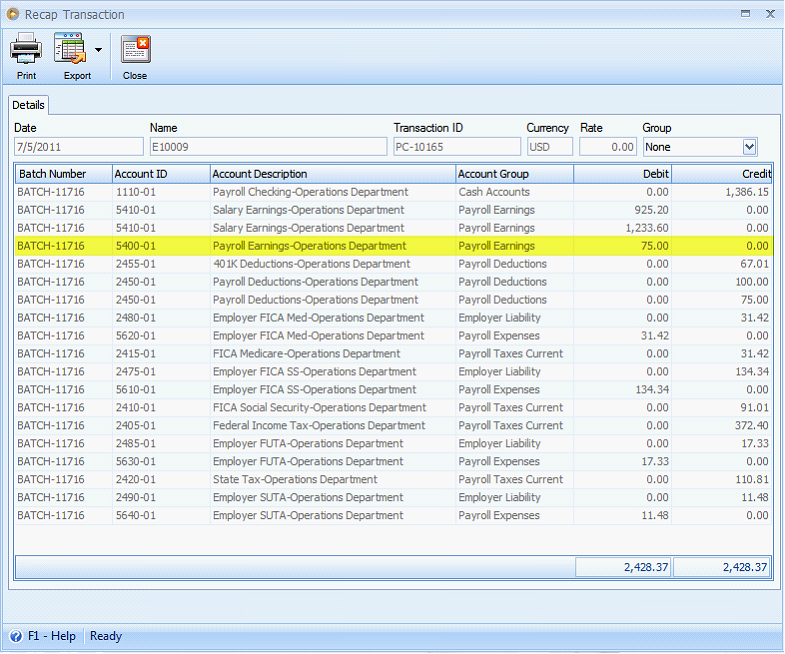

A G/L entry will also be created if tips were given to the employee as part of the paycheck.

Reference: Task 2118