Payroll Reimbursements

Reimbursements are used for money included in the net pay and not part of any employee’s payroll. This is exempt from all taxes and all tax reporting. You can use Reimbursement to pay an employee non-payroll money like meals or gas money example.

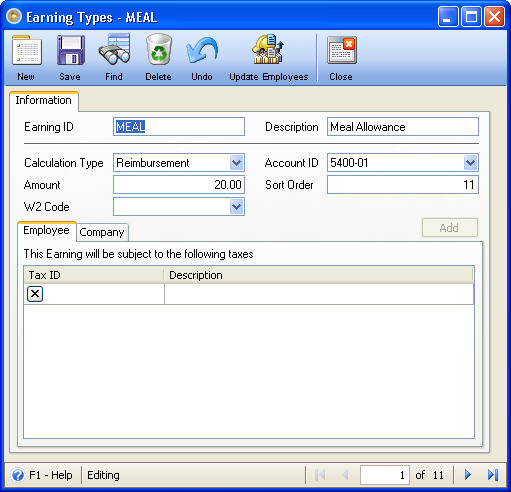

To setup a reimbursement, open the Earning Types form and create a new Type selecting Reimbursement from the Calculation Type combo box.

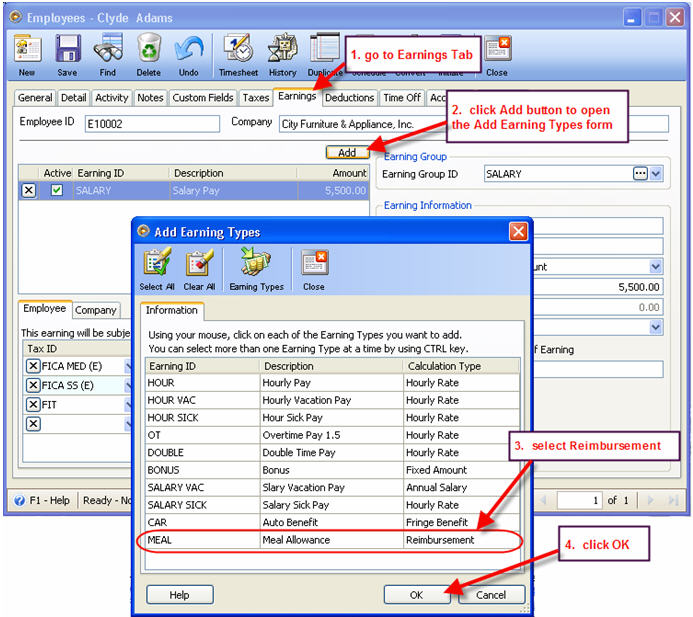

In the Employee form, click on Earnings tab and add the fringe benefit.

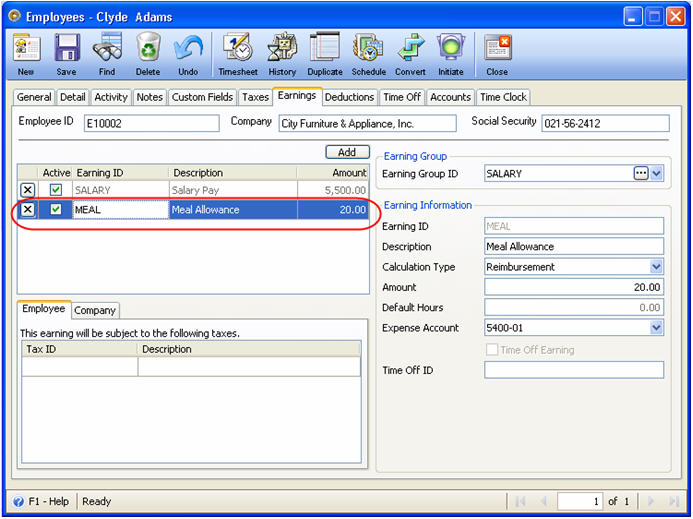

Notice there are no associated taxes assigned to this earning.

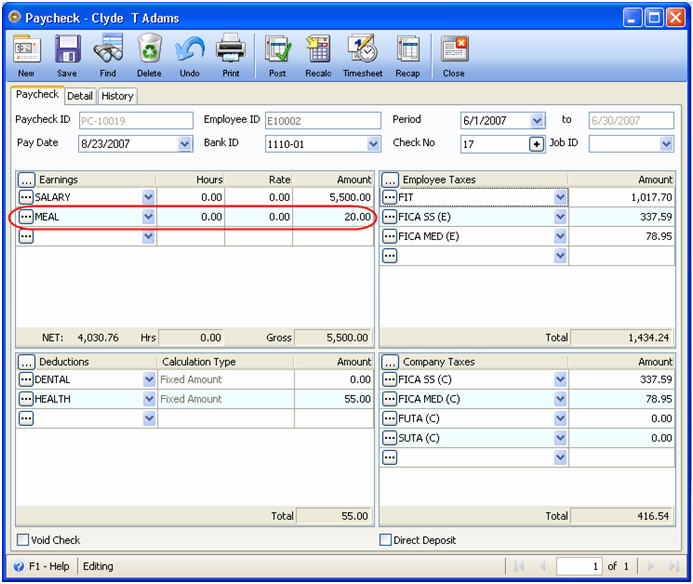

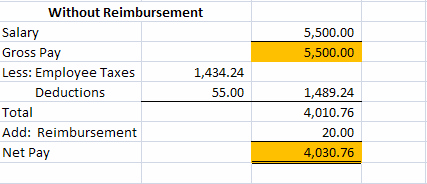

When you create a paycheck; the MEAL reimbursement of 20.00 only increases the Net Pay. The Gross Pay, taxes and deductions remain unchanged by this earning.

The MEAL reimbursement of 20.00 only increases the Net Pay. The Gross pay, taxes and deductions remain unchanged by this earning.

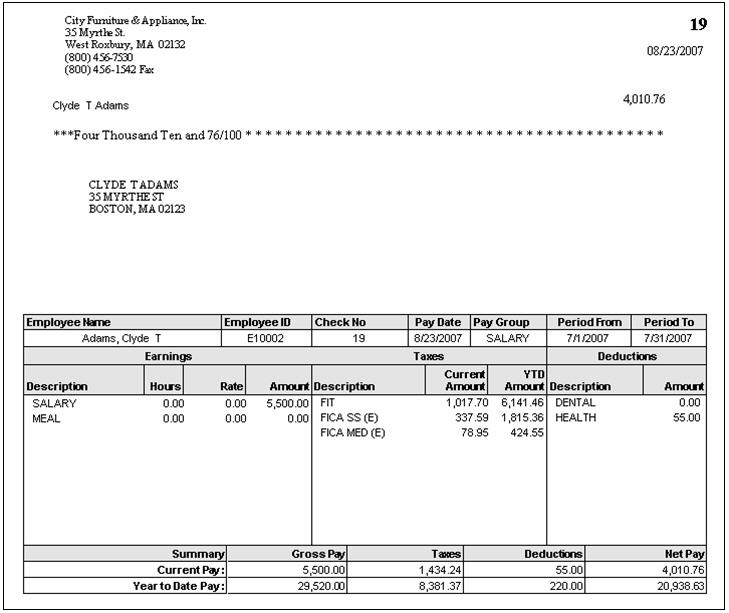

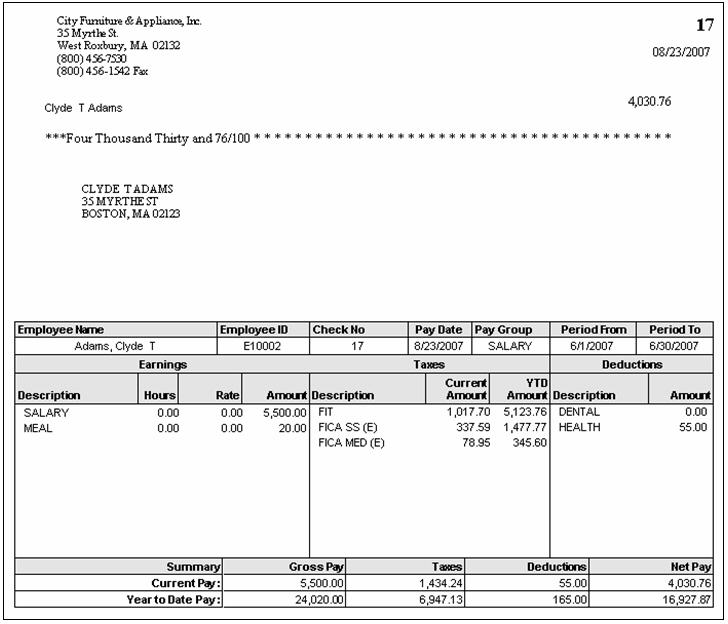

Here is how the paycheck report would look.

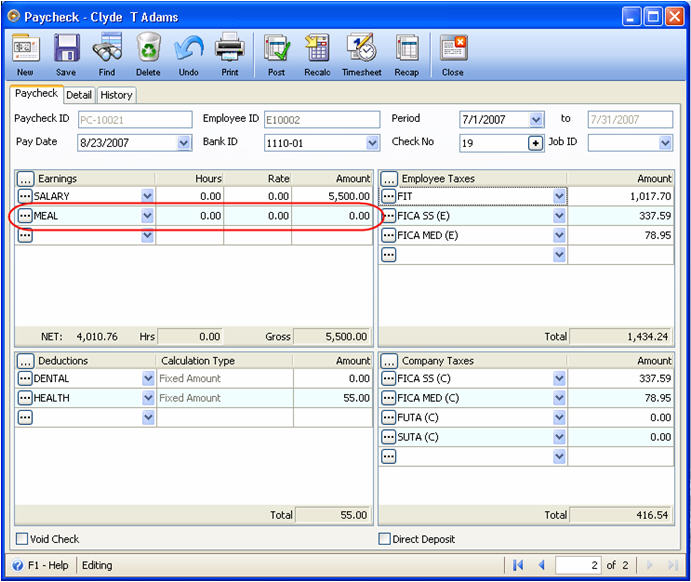

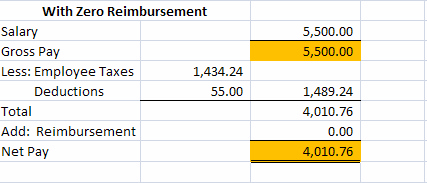

If you change the MEAL reimbursement of 20.00 to 0.00 you will notice only the Net pay changes reducing it from 4,030.76 to 4,010.76. The Gross Pay is still the same at 5,500.

Here is how the paycheck report would look.