How to apply Use Tax that uses the GL Account of the Line Item on the Bill

When creating Use Tax Codes, users have the option to assign any account other than an expense or liability account or still use the assigned GL account for line item on the Bill, on Tax Components [Purchasing] form.

Here’s how Use Tax that uses the GL account of the line item on the Bill is applied.

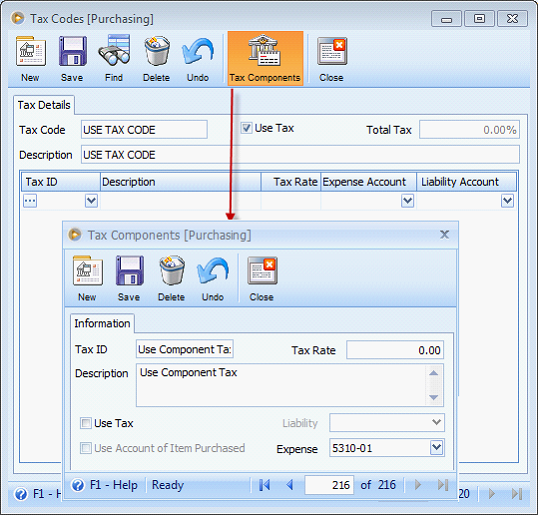

1.Open Tax Components [Purchasing] form from Purchases > Tax Codes [Purchasing] > Tax Components button.

2.Click New button to add a new tax component.

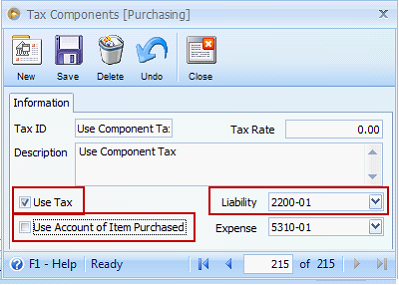

3.Checking Use Tax option enables Liability as well as the Use Account of Item Purchased fields.

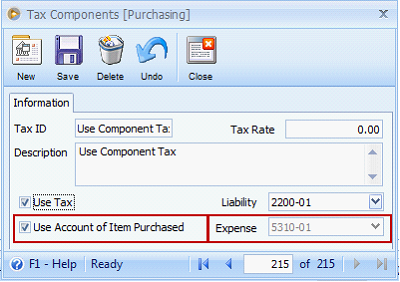

4.Checking Use Account of Item Purchased disables the Expense account code dropdown. When checked, applicable use tax amount will be credited to the GL account of the line item.

When a line item on a Bill uses a tax code with this tax component, assigned GL account for line item on the Bill is used.

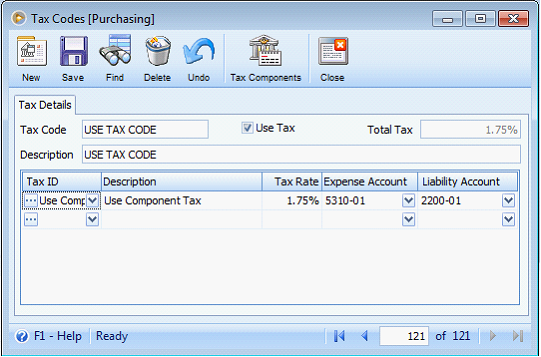

1.This is the setup for Tax Code [Purchasing] used.

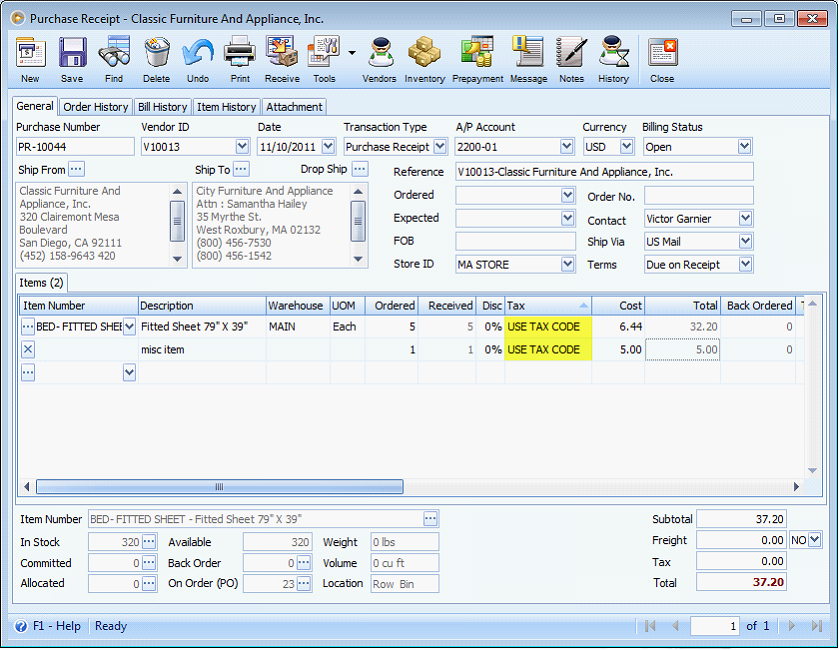

2.Create a Purchasing Receipt and add items. Apply the Use Tax Code created.

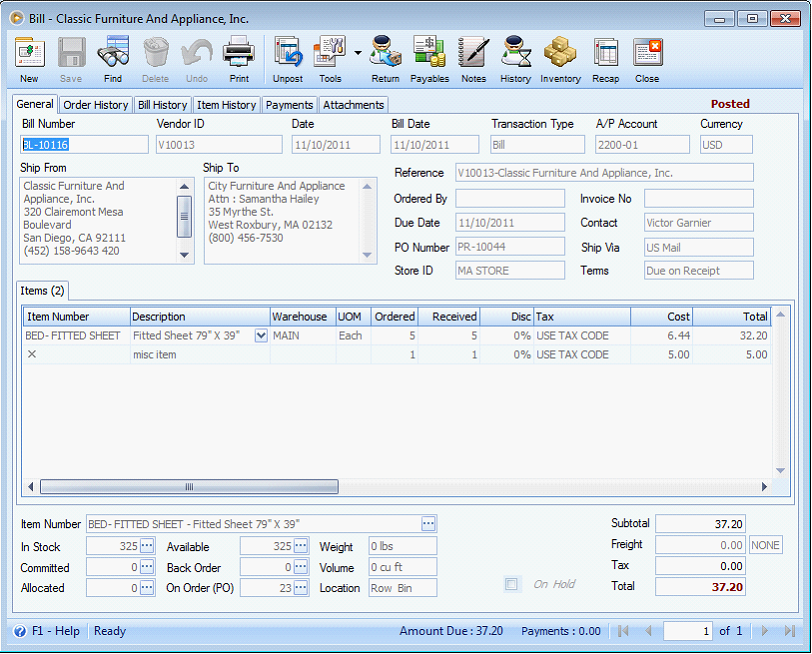

3.Process it to Bill and post.

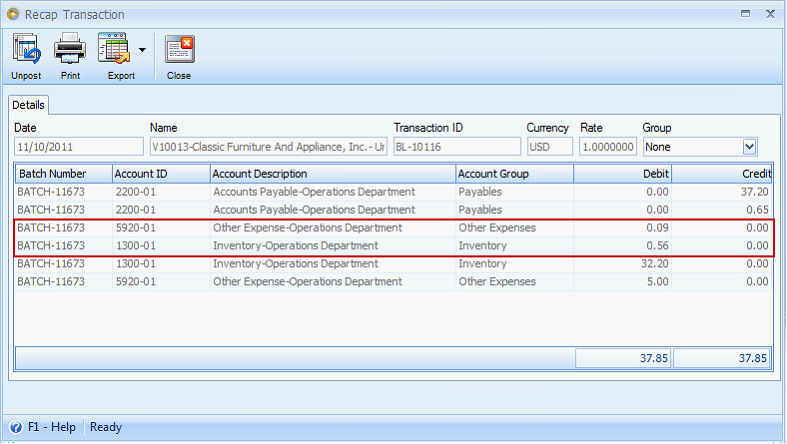

Checking the General Ledger form, assigned GL account for line item on the Bill is used.

Task: 1732