How 1099-B works

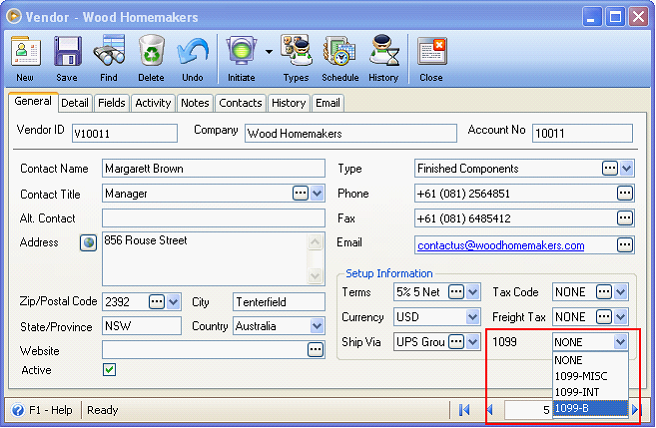

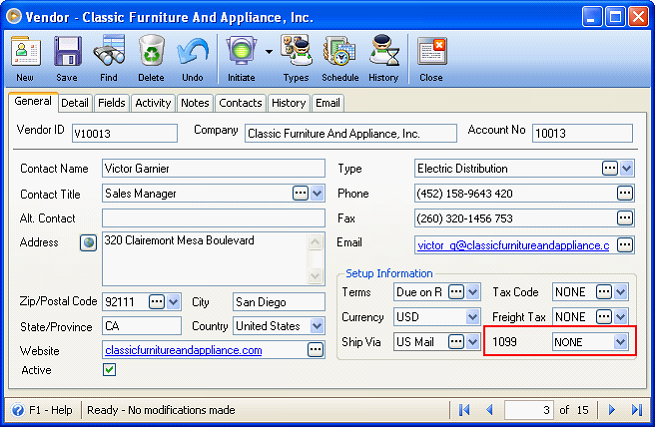

Assign 1099-B to a selected Vendor.

If a Vendor is set to be 1099-B, the 1099-B column in these transactions (Purchase Order, Purchase Receipt, Bill, Return to Vendor and Debit Memo) will show 1099-B as well. However you can modify it if you need to.

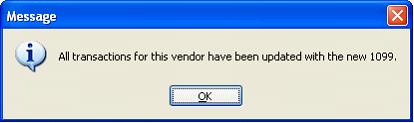

In case a Vendor has existing bills prior to setting this up (selecting 1099-B in the 1099 field), this message will be shown. Clicking YES will update all transactions to have 1099-B in the column field for this vendor.

Then this message will be shown. Click OK.

1099-B Report

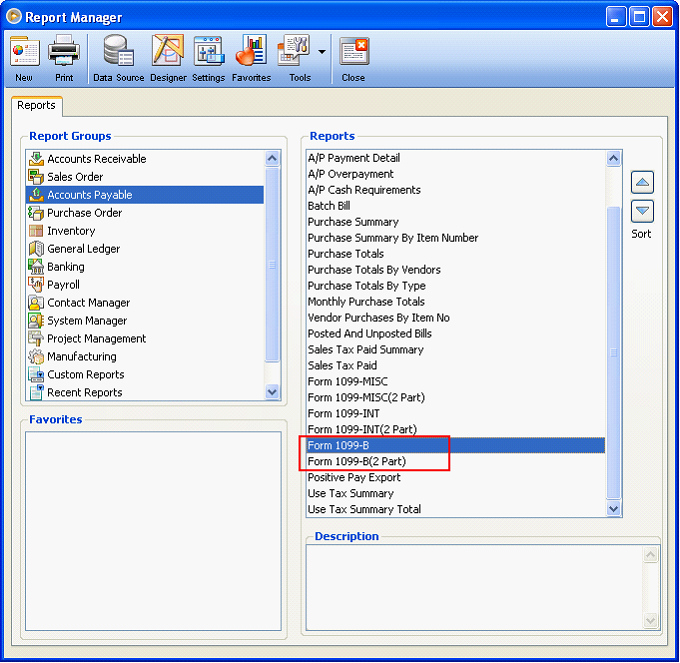

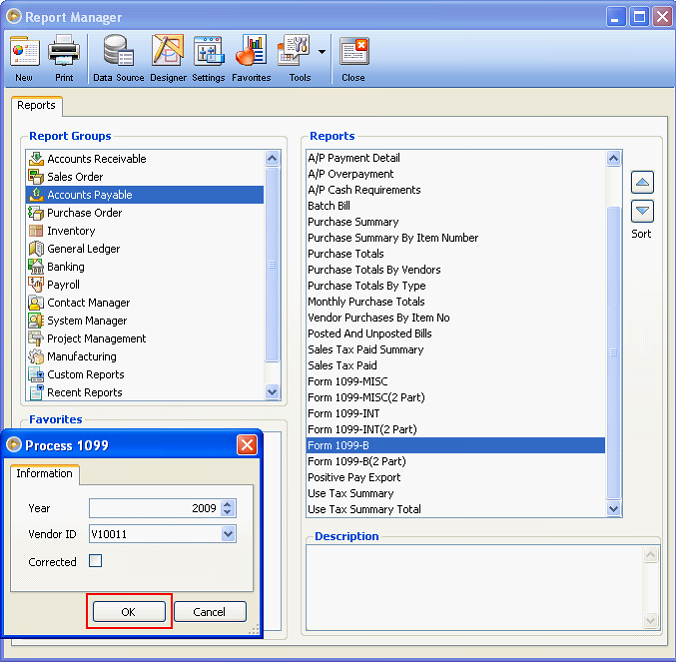

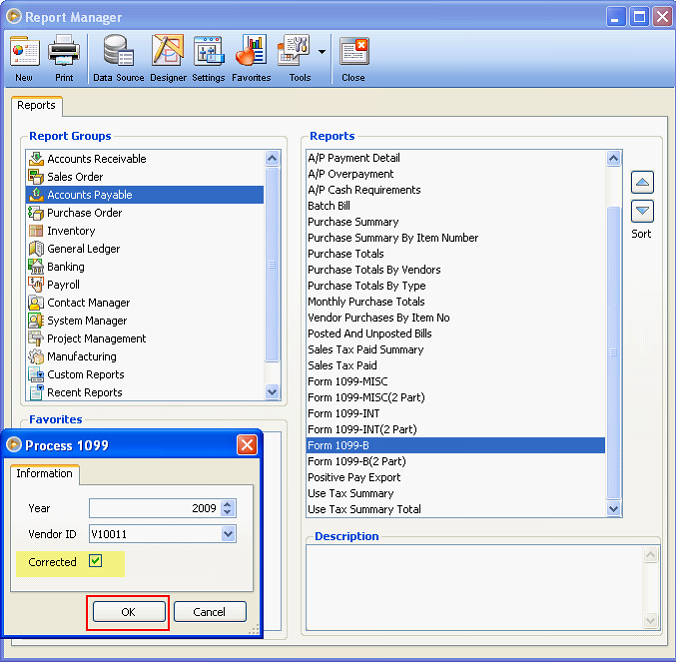

You can open 1099-B reports from the Report Manager form – Accounts Payable group.

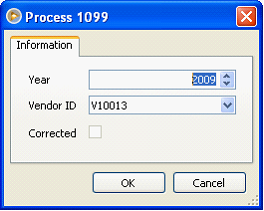

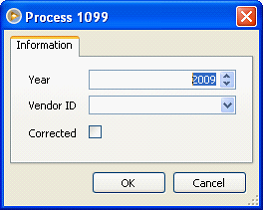

When you try to print this report, the Process 1099 form will be shown. Select a Year and Vendor ID. But if you choose to select all vendors, just leave the Vendor ID field blank.

If this is the first time you process a 1099-B report, leave the Corrected checkbox disabled. See example 1.

But if after processing a 1099-B report and you posted or unposted a bill payment (Paid Bills) transaction, you will have to enable the Corrected checkbox to get the latest changes made on the Paid Bills thus getting the correct amount. See Example 2.

![]() Note that only Bills that are paid will be considered when printing Form 1099-B reports.

Note that only Bills that are paid will be considered when printing Form 1099-B reports.

Example 1:

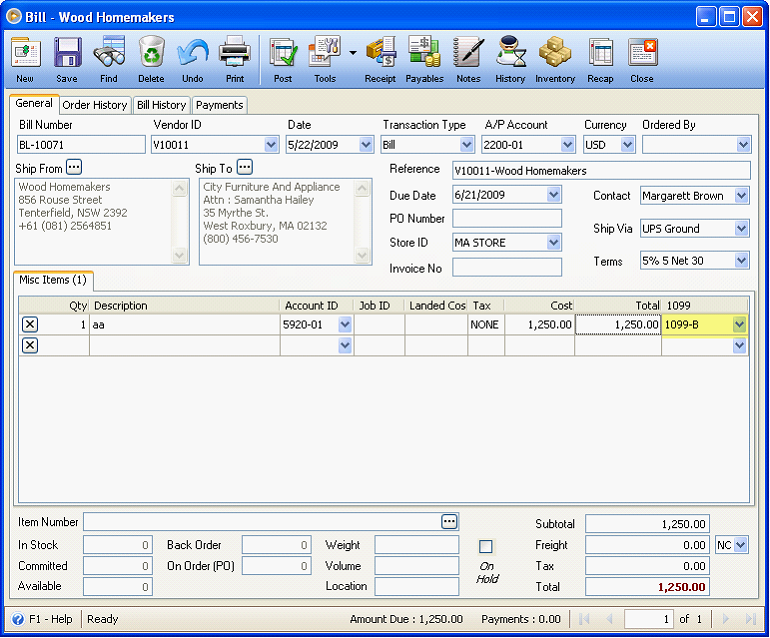

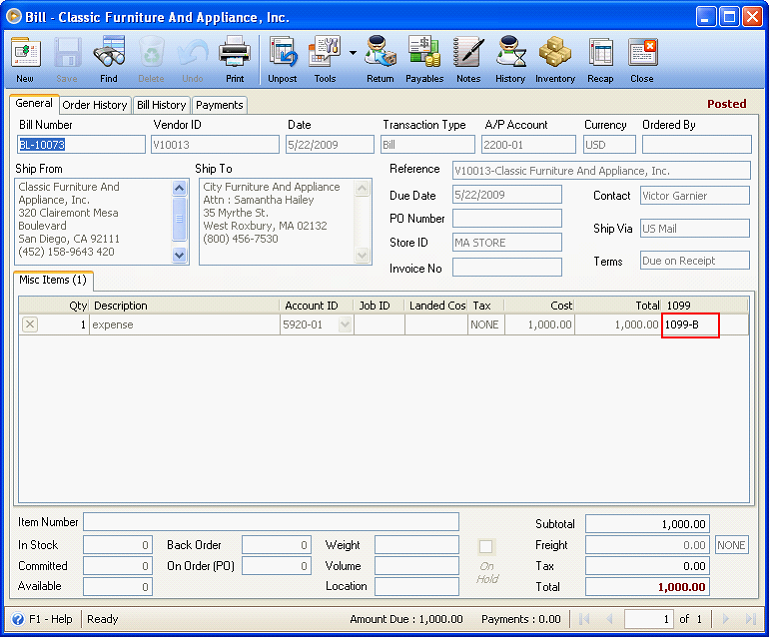

Create a Bill with Vendor 1099 field set as 1099-B.

Notice that after adding a line item, 1099 field is automatically defaulted to 1099-B.

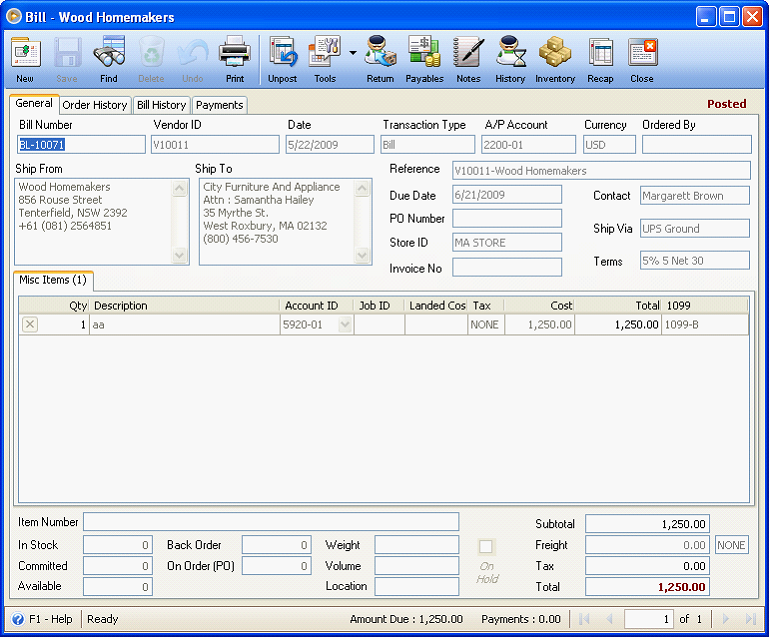

Then post this bill.

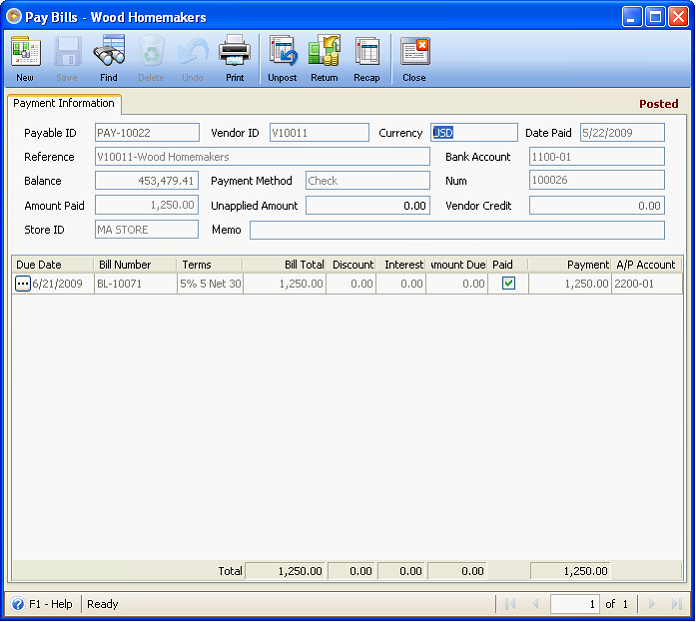

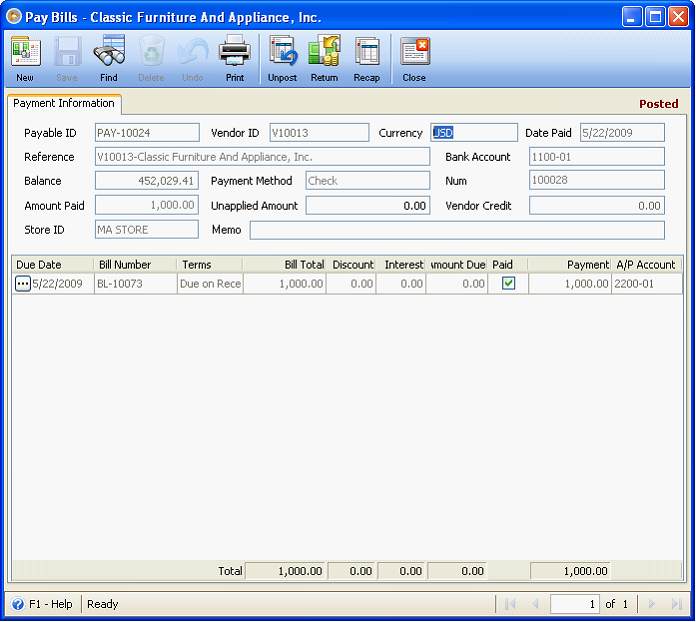

Then pay this Bill.

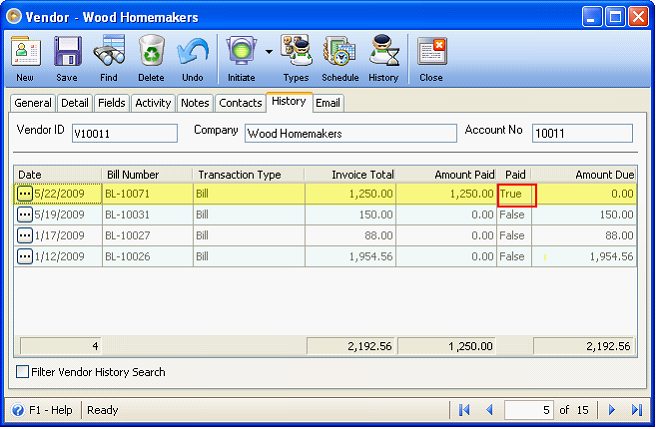

Check Vendor History to make sure Amount Paid is the same with Invoice Total, Paid is set to True and Amount Due is 0.00

Now let us try to print 1099-B report.

![]() Note that if a Bill has 3 line items and only 1 of those line items is tagged as 1099-B, then that line item will only be honored. See Example 2.

Note that if a Bill has 3 line items and only 1 of those line items is tagged as 1099-B, then that line item will only be honored. See Example 2.

Example 2:

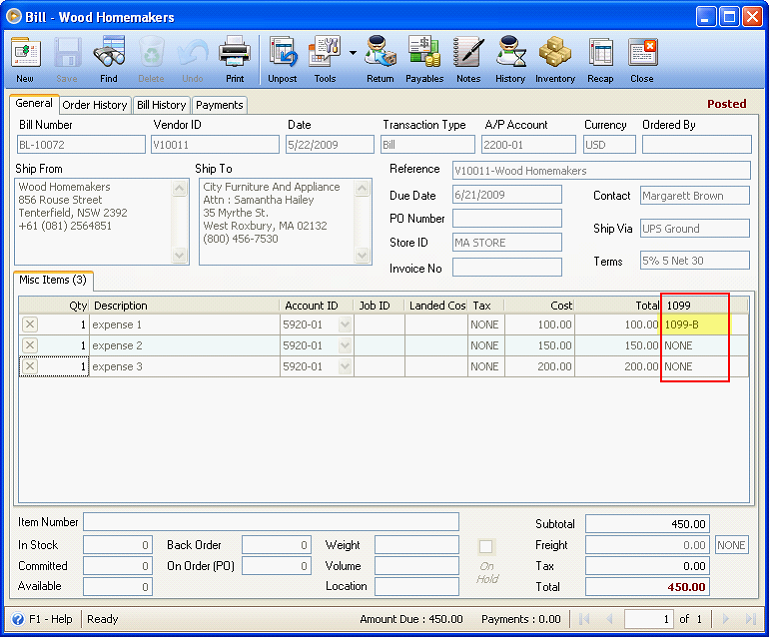

Create New Bill. Make 3 items, 1 is set to ‘1099-B’ and the remaining is set to ‘NONE’. Then Post this bill.

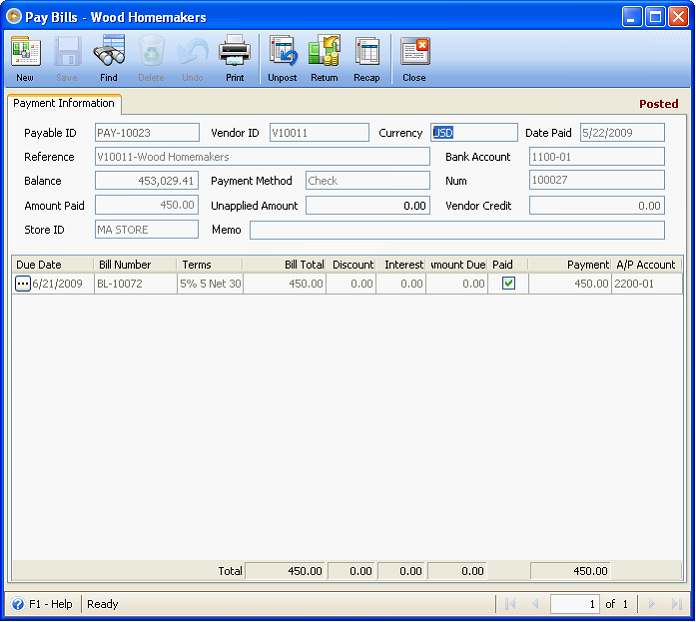

Pay this Bill.

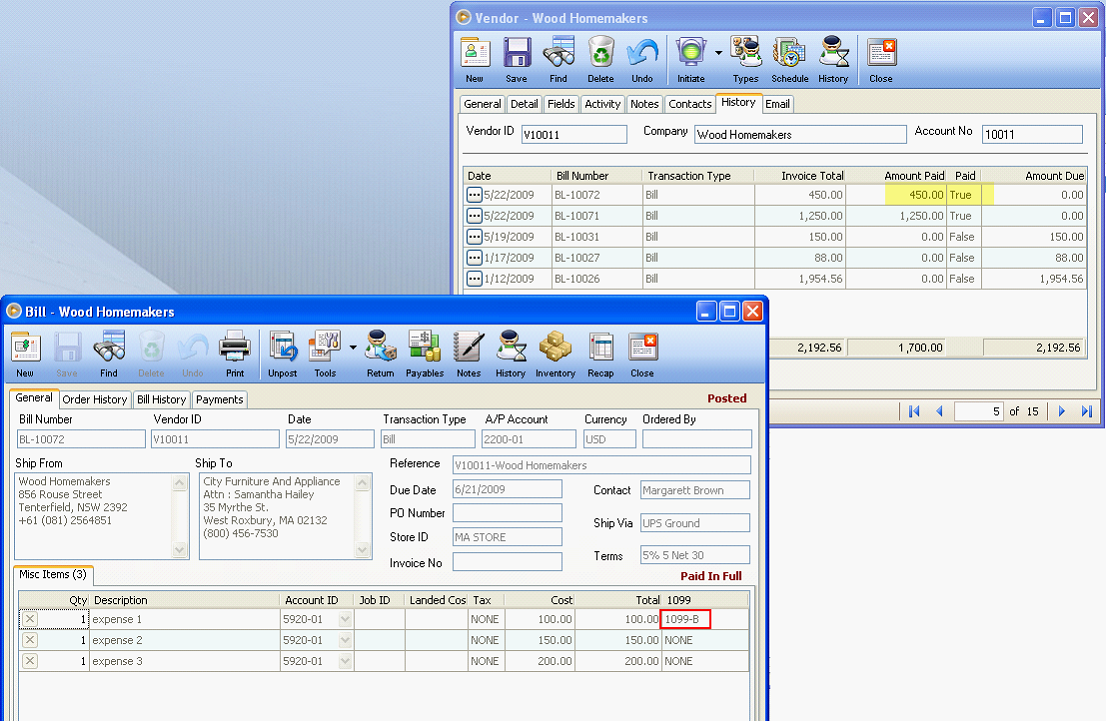

Now before printing the 1099-B reports, go back and review the Bill transaction and the Vendor history. Out of the 450 paid bill, only 100 will be considered in 1099-B reports.

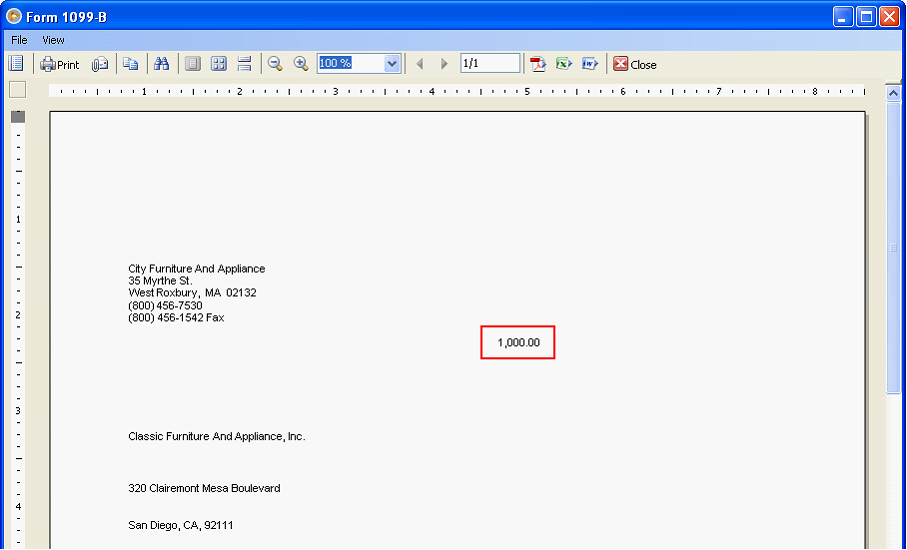

At this point, print Form 1099-B report. Enable the Corrected checkbox and click OK.

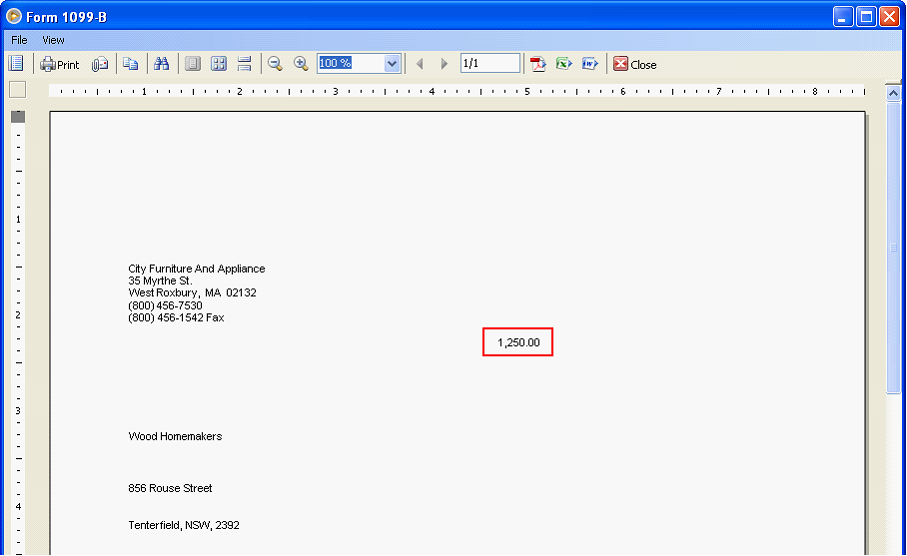

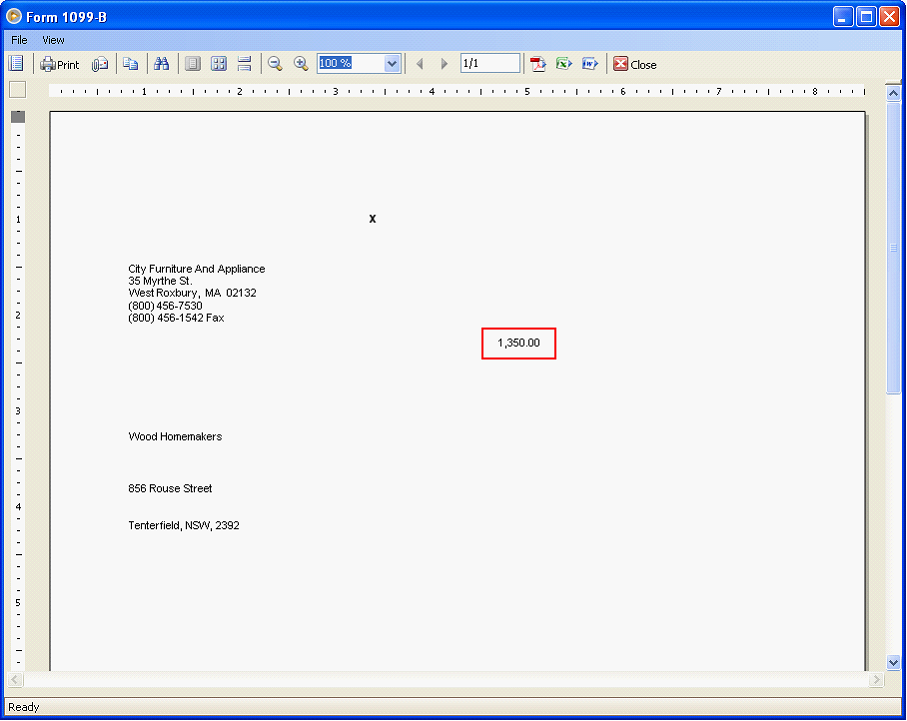

The Form 1099-B report will show 1,350. The breakdown of V10011 transactions included in the computation of 1099-B amount is the following:

|

|

|

|

Total 1099-B Amount |

BL-10071 |

1099-B |

1,250.00 |

1,250.00 |

|

|

|

|

|

|

BL-10072 |

1099-B |

100.00 |

|

1,350.00 |

|

NONE |

150.00 |

|

|

|

NONE |

200.00 |

450.00 |

|

Total Paid Bills |

|

|

1,700.00 |

|

![]() Note that whether the Vendor is set to be using 1099-B or not, for as long as there are bills marked as 1099-B and Payments are made, then Bills should be honored as 1099-B of the Vendor. See Example 3.

Note that whether the Vendor is set to be using 1099-B or not, for as long as there are bills marked as 1099-B and Payments are made, then Bills should be honored as 1099-B of the Vendor. See Example 3.

Example 3:

This Vendor is not set as 1099-B.

But a bill is created for that Vendor and is tagged as 1099-B.

And the Bill is paid.

Then printing a 1099-B report for this Vendor will honor that bill as 1099-B.