Generating Form W-2

The W-2 form is used to report an employee's annual wages and the amount of taxes withheld from his/her paycheck.

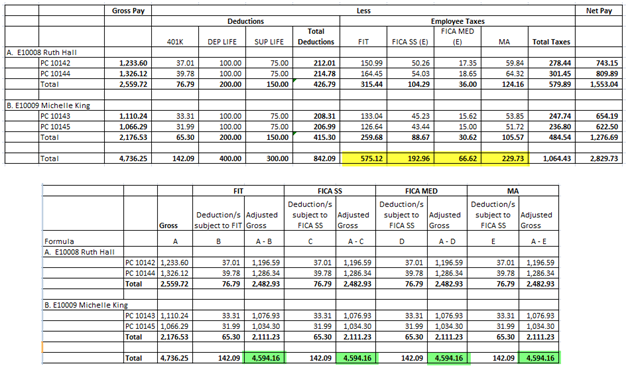

For the purpose of this illustration, let’s assume that at the end of 2011, there are 2 paychecks generated for each of these employees:

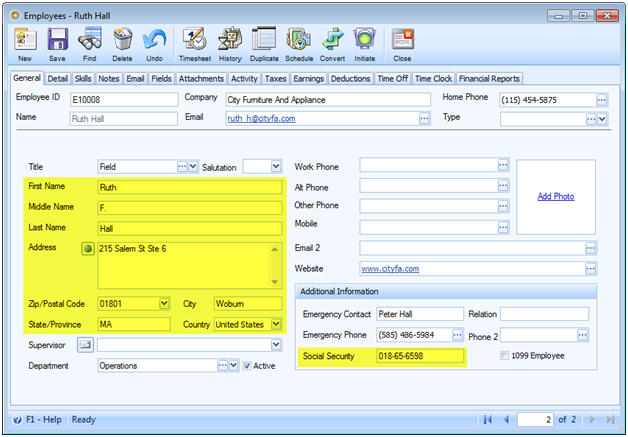

![]() E10008-Ruth Hall

E10008-Ruth Hall

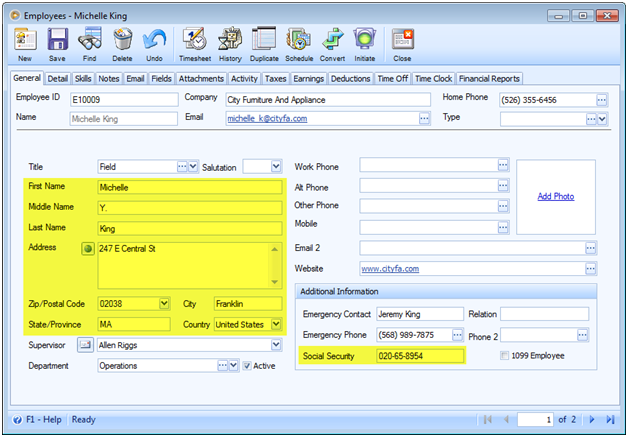

![]() E10009-Michelle King

E10009-Michelle King

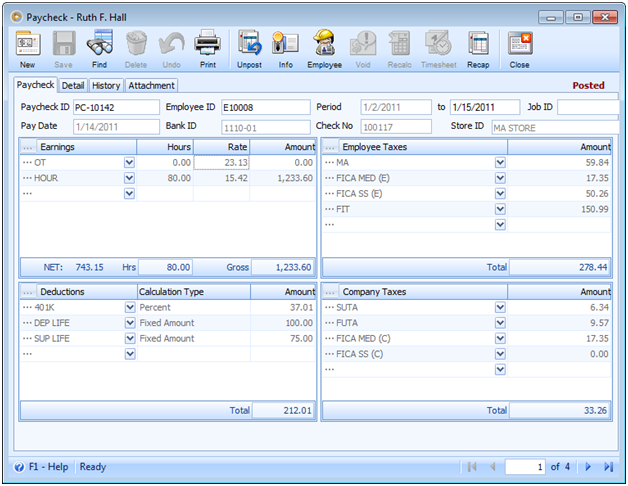

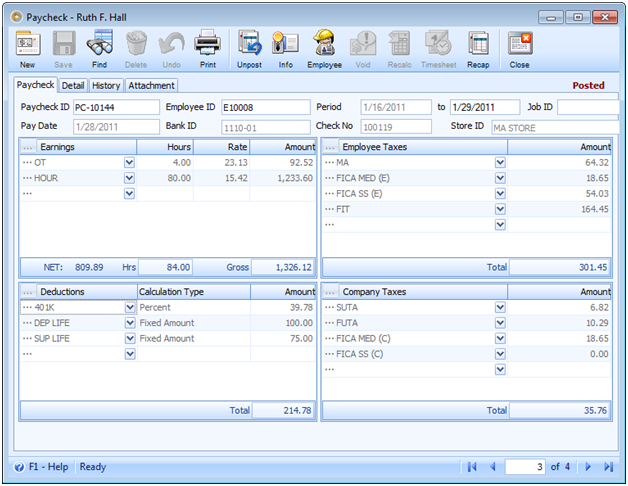

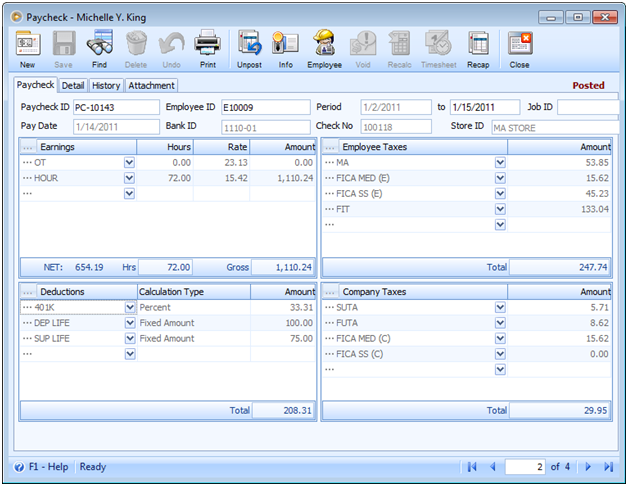

Here are paychecks created for the above employees.

E10008-Ruth Hall

![]() First paycheck

First paycheck

![]() Second paycheck

Second paycheck

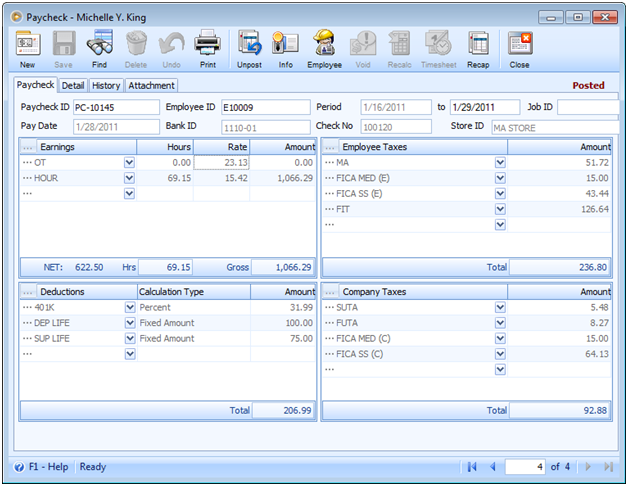

E10009-Michelle King

![]() First paycheck

First paycheck

![]() Second paycheck

Second paycheck

![]() Note that W-2 will be created/generated only for employees who have had payroll transactions within the selected year.

Note that W-2 will be created/generated only for employees who have had payroll transactions within the selected year.

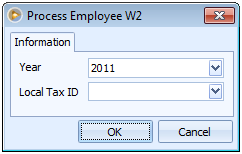

1.To generate W-2, go to Payroll menu > select Process Employee W-2 to open Process Employee W-2 mini-form. Select the Year and the Local Tax ID and click OK to create employee W-2.

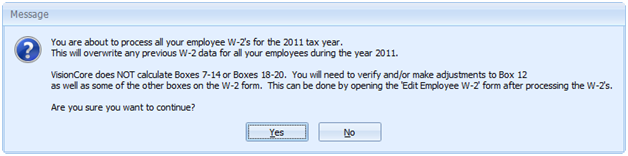

This message will then be shown.

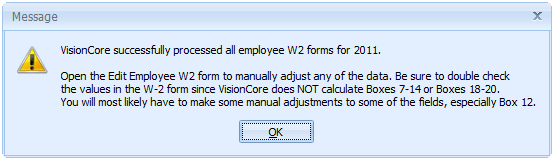

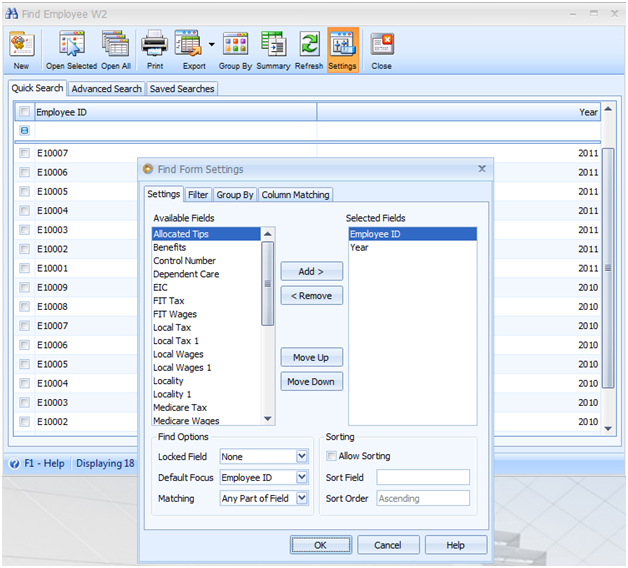

Click Yes button and this another message will be shown.

2. Now to view the created Employees’ W-2, go to Payroll menu > select Edit Employee W-2 to open the Find Employee W-2 form. In this find form, you will see all employees’ W-2 records created. You can click the Settings button and add the Year or any field you would want to be shown in the find form.

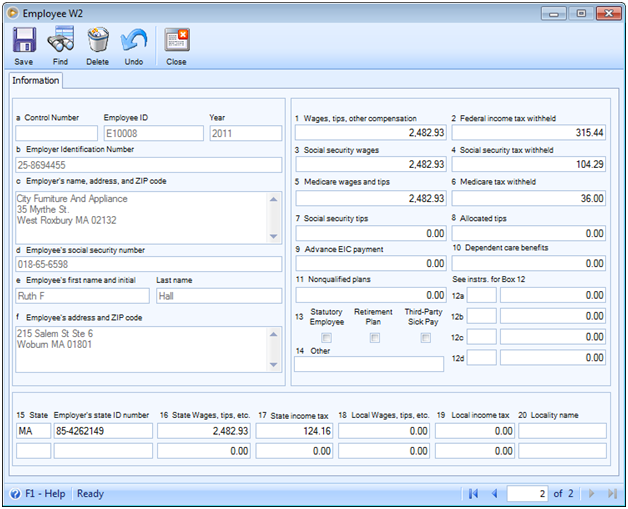

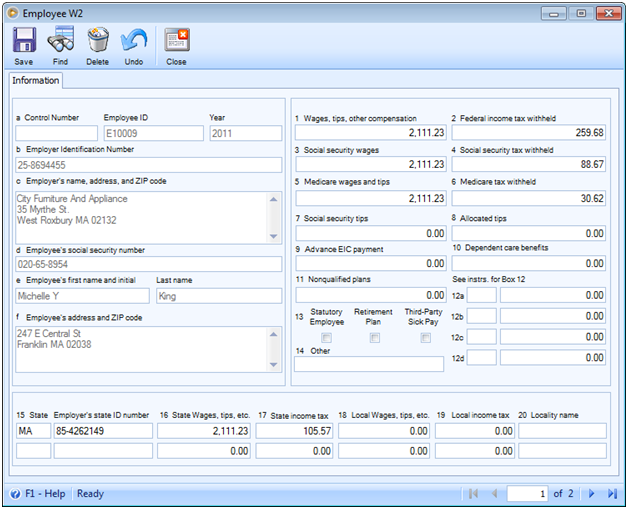

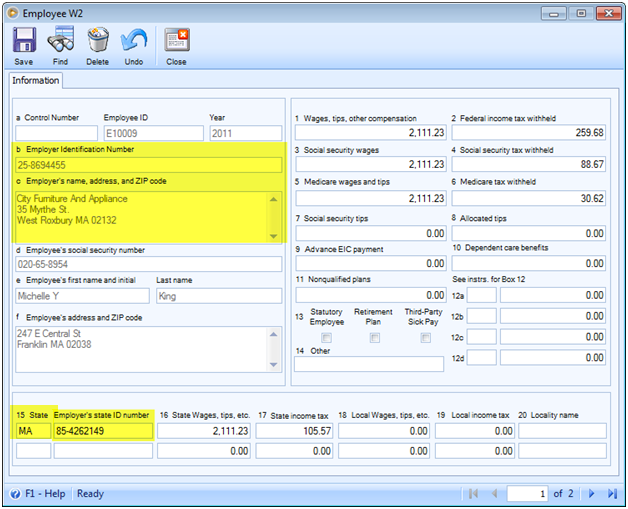

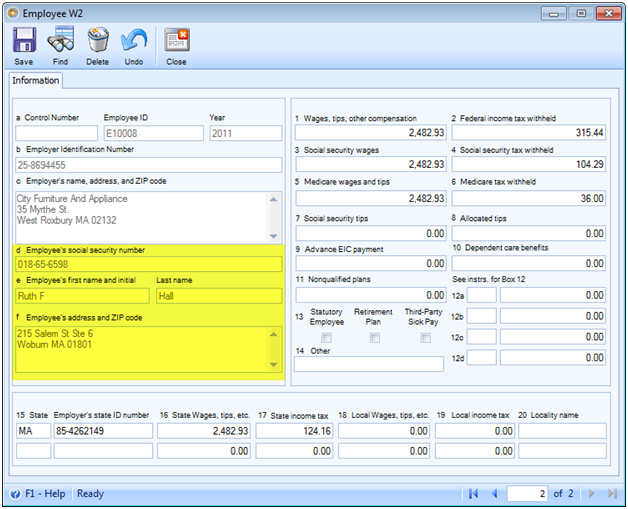

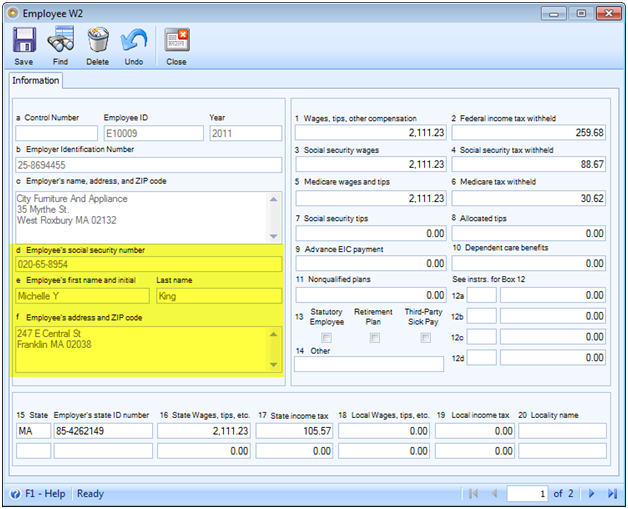

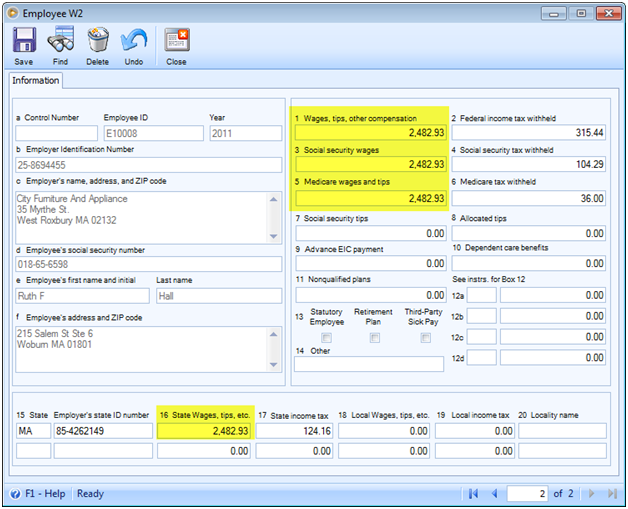

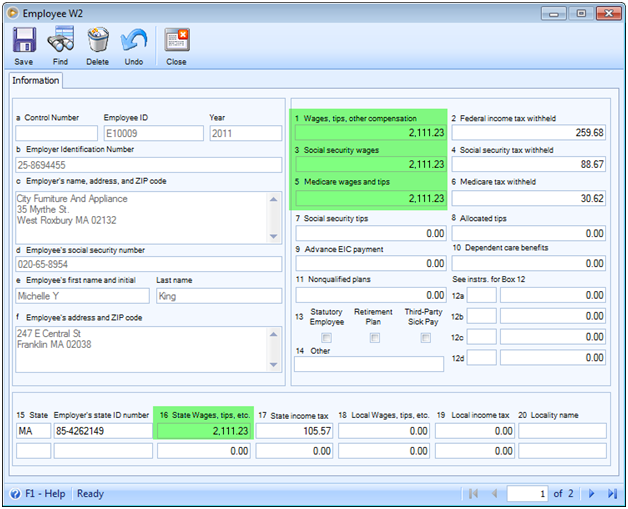

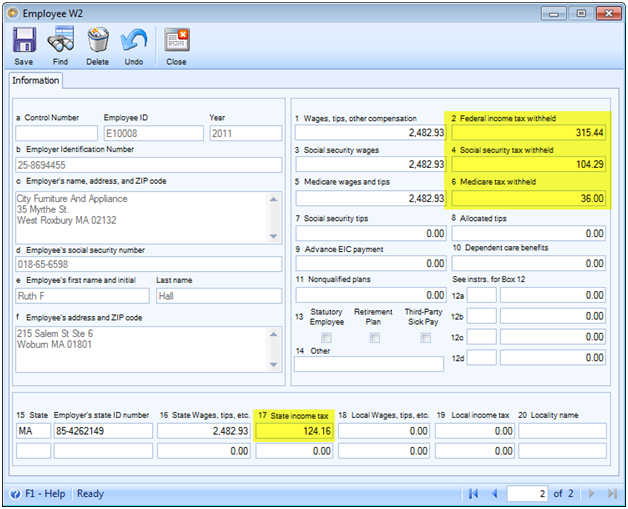

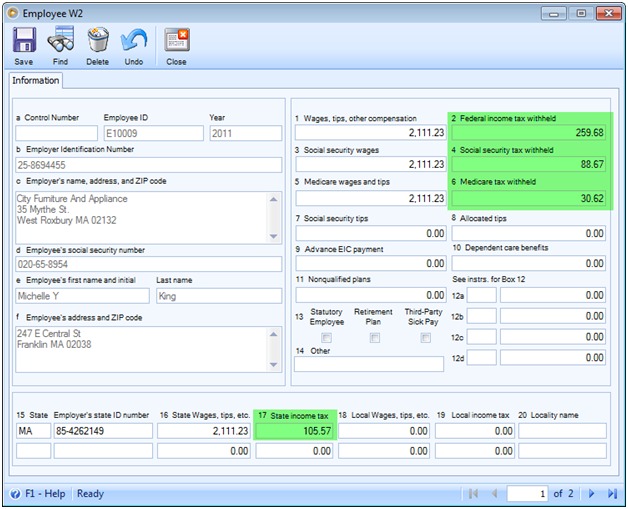

Select to open employee’s w-2 records for E10008 and E10009 for the year 2011.

![]() Note that W-2 will be created/generated only for employees who have had payroll transactions within the selected year.

Note that W-2 will be created/generated only for employees who have had payroll transactions within the selected year.

It is on this form that you will have the ability to manually adjust any of the data generated. Be sure that you double check the values since VisionCore does not calculate Boxes 7-14 and Boxes 18-20.

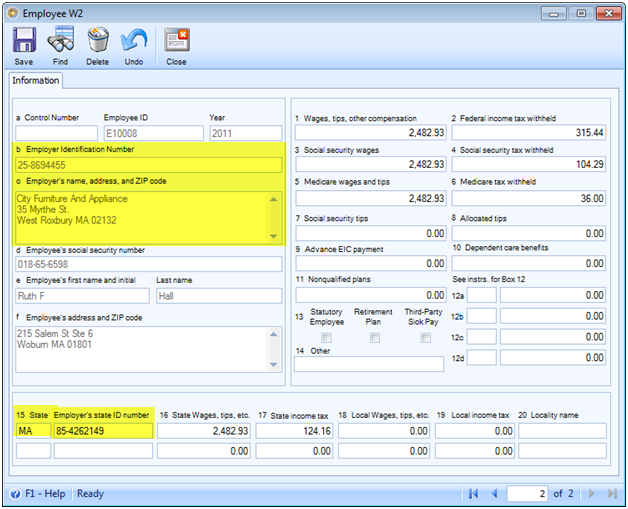

To give you details where and how the values are computed, see the following screenshots.

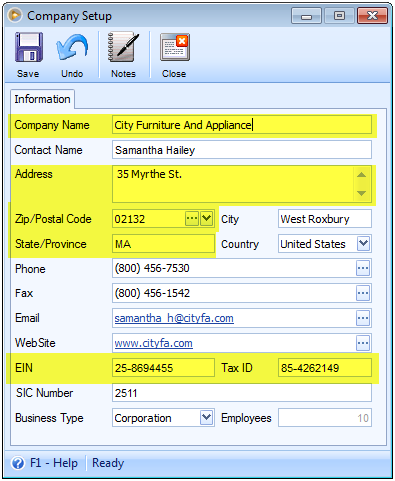

![]() Boxes b, c and 15

Boxes b, c and 15

were taken from: Company Setup form

![]() Boxes d, e and f

Boxes d, e and f

were taken from: Employee form

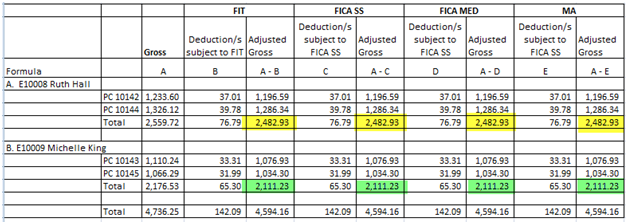

![]() Boxes 1, 3, 5 and 16

Boxes 1, 3, 5 and 16

were computed based on Adjusted Gross. To compute for adjusted gross, you will have to deduct deductions subject to a particular tax. Example, if you want to get the Adjusted Gross for FIT, deduct all deductions subject to FIT from Gross. For Adjusted Gross for FICA SS (E), deduct all deductions subject to FICA SS (E) from Gross and so on and so forth. See illustration below.

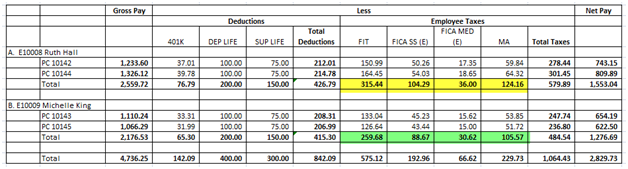

![]() Boxes 2, 4, 6 and 17

Boxes 2, 4, 6 and 17

were computed after adding up all taxes withheld every employee’s paycheck for 2011.

For definitions of the fields on the W-2, see this link from IRS. Each is explained in details.

http://www.irs.gov/instructions/iw2w3/ch01.html#d0e1830

3. Once everything is good, you may now save and close Employee W-2 form.

4. To print W-2 reports, go to Report menu > when the Report Manager opens > select Report Groups and select to print W-2 reports available.

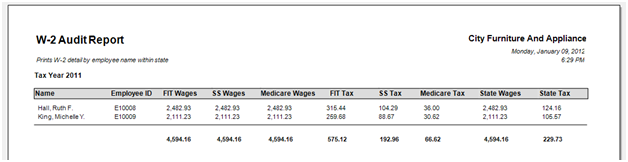

W-2 Audit Report

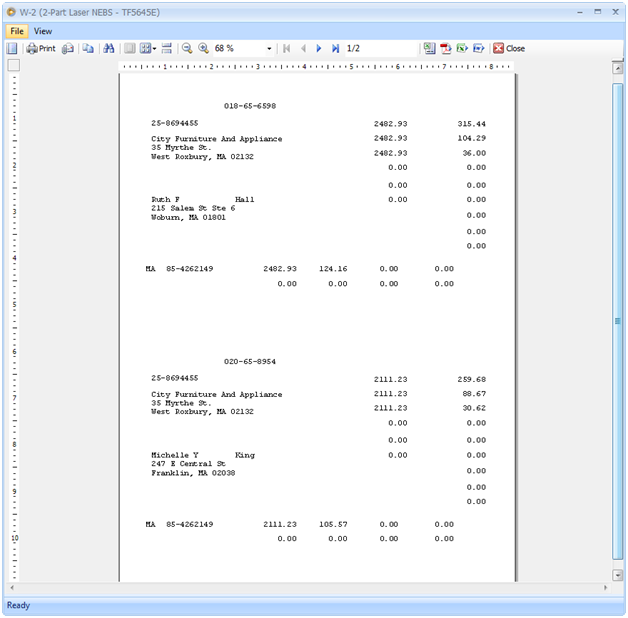

W-2 (2-Part Laser NEBS – TF5645E)

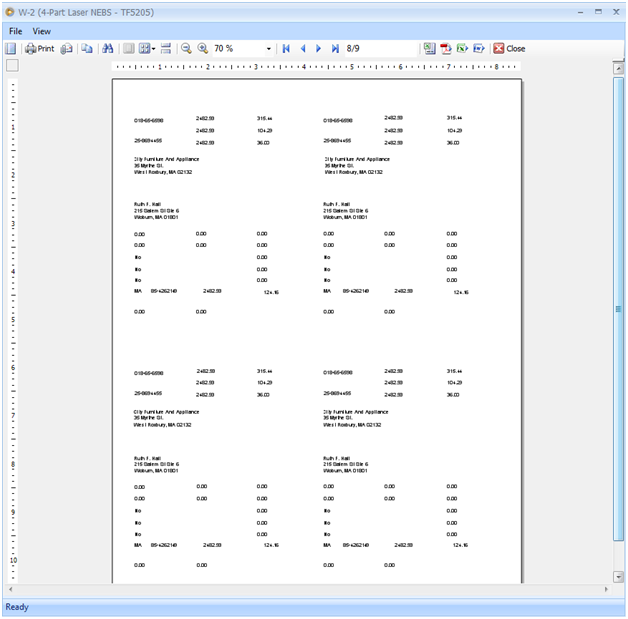

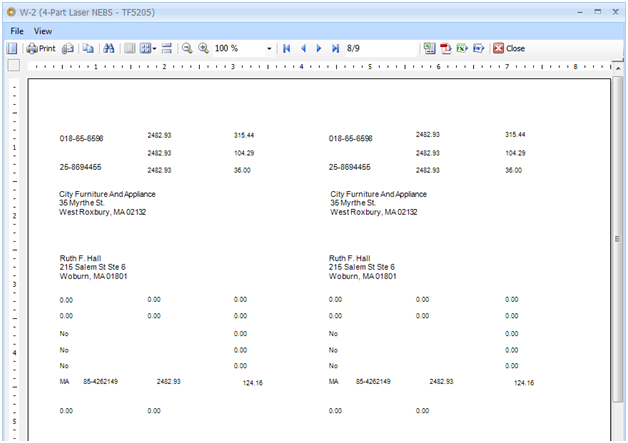

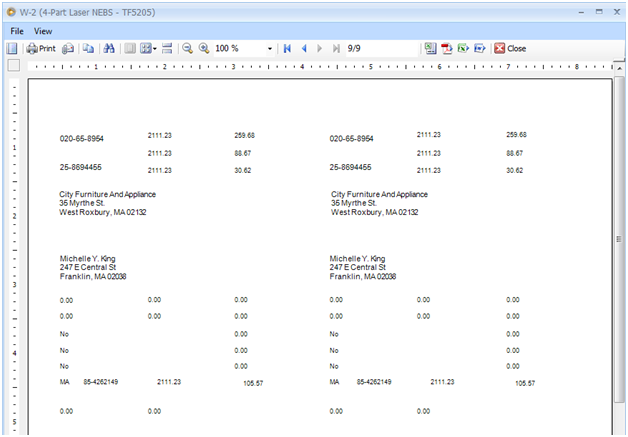

W-2 (4-Part Laser NEBS – TF5205)

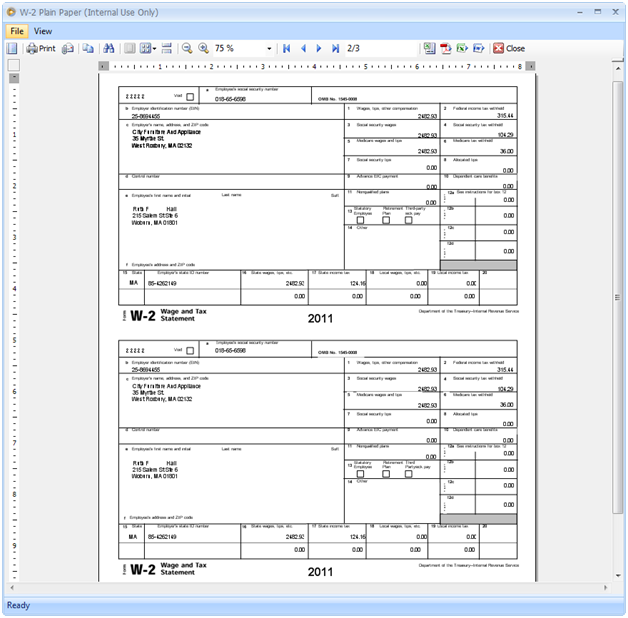

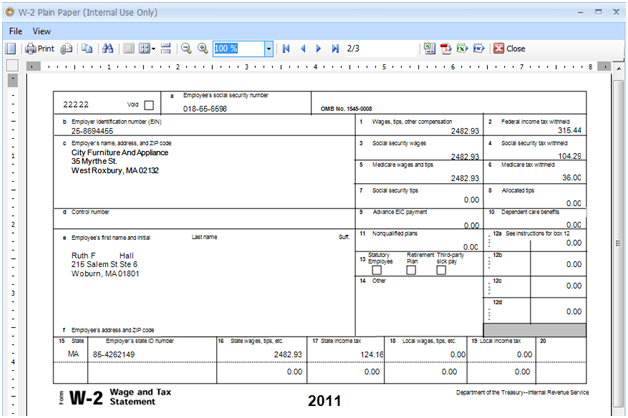

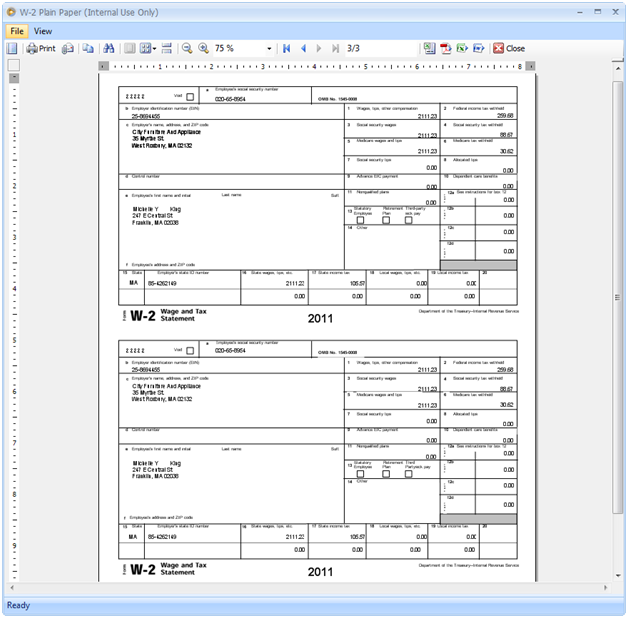

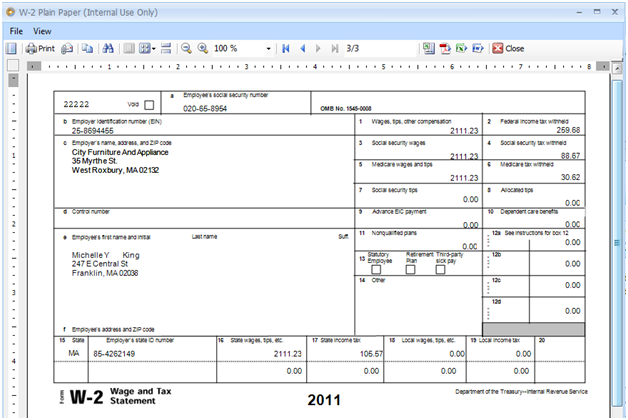

W-2 Plain Paper (Internal Use Only)

Here is how each of the above report will look like.

![]() W-2 Audit Report

W-2 Audit Report

![]() W-2 (2-Part Laser NEBS – TF5645E)

W-2 (2-Part Laser NEBS – TF5645E)

![]() W-2 (4-Part Laser NEBS – TF5205)

W-2 (4-Part Laser NEBS – TF5205)

The above is just an overview of the entire page just to show you that the report is showing information in 4 parts for each employee. The screenshot that follows will show you a closer view of the above screenshot.

![]() W-2 Plain Paper (Internal Use Only)

W-2 Plain Paper (Internal Use Only)

The above is just an overview of the entire page. The screenshot that follows will show you a closer view of the above screenshot.

The above is just an overview of the entire page. The screenshot that follows will show you a closer view of the above screenshot.

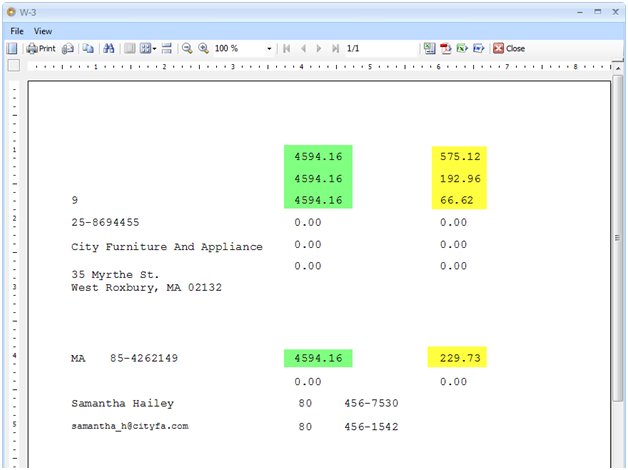

There is also a W-3 report that you can generate. If W-2 report is used to show an employee’s annual wages and the amount of taxes withheld from his/her paycheck, W-3 report will show the sum of all employees’ annual wages and the amount of taxes withheld. Paycheck information are added up together and then rounded to the nearest 2 decimals.

See the illustration below as to how the figures above are computed.