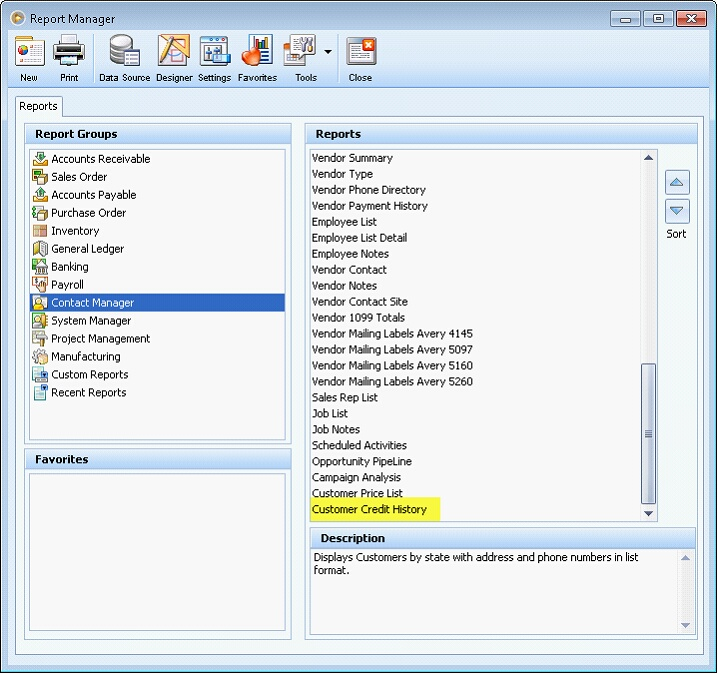

Customer Credit History Report

New report is added under Contact Manager Group called Customer Credit History.

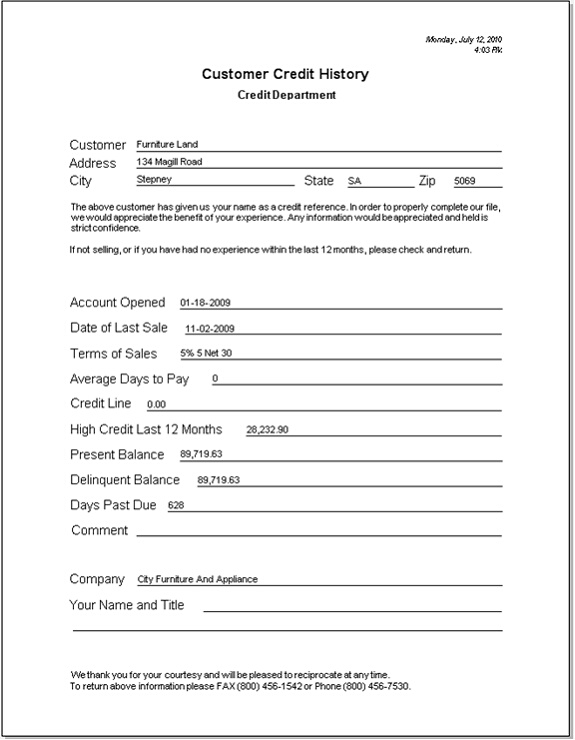

Customer Credit History Report Layout

Below are the significant fields of this report and its description:

Account Opened – Date the customer record is created

Date of Last Sale – The last posted Invoice of the customer

Terms of Sales – Terms setup in the Customer form.

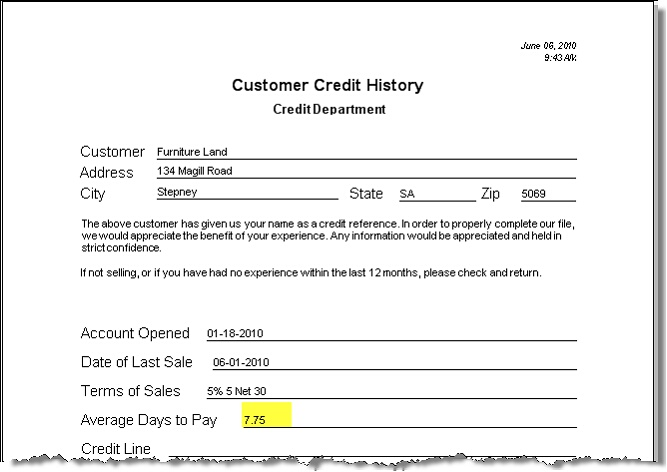

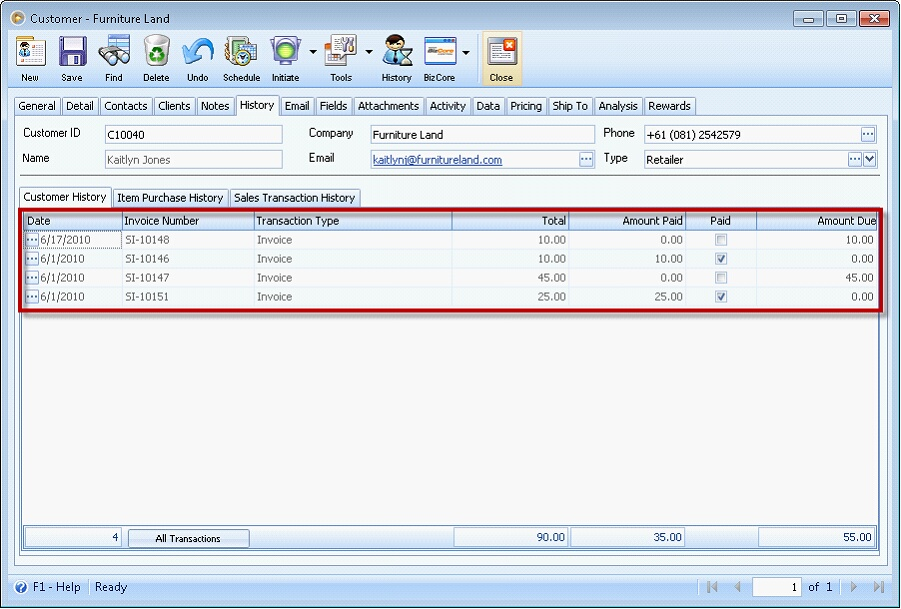

Average Days to Pay – This field will use this formula: “the Total Number of Days to Pay divided by the Number of Closed Invoices”.

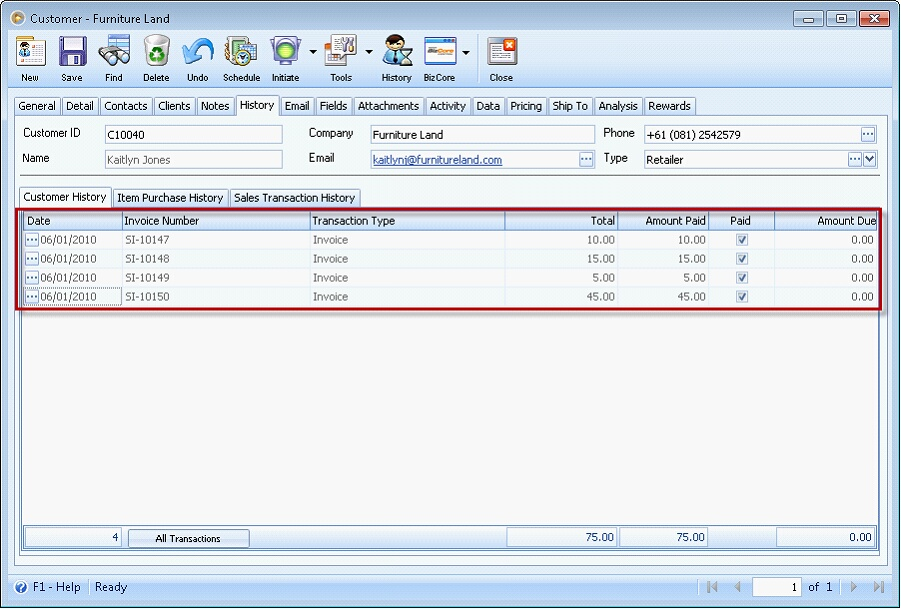

For Example, C10040 has 4 closed Invoices.

SI-10147 was paid 5 days after the invoice date.

SI-10148 was paid 10 days after the invoice date.

SI-10149 was paid 15 days after the invoice date.

SI-10150 was paid 0 days, paid on the same day the invoice is posted.

The total day until paid is 30. Using the above formula, divide this figure by the number of closed invoices; 30/4; equals 7.5 as the average days to pay.

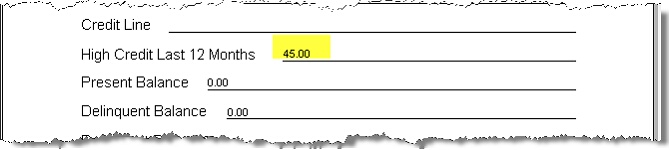

Credit Line – this field is for the credit limit of the customer but will leave as blank on the report.

High Credit Last 12 Months – this field will use this formula: “the Highest Posted Invoice for the customer in the last 12 months since printing the report”

Using the sample customer above, the highest posted invoice in the last 12 months is $45 from SI-10150. So this will be the amount that will reflect on the report.

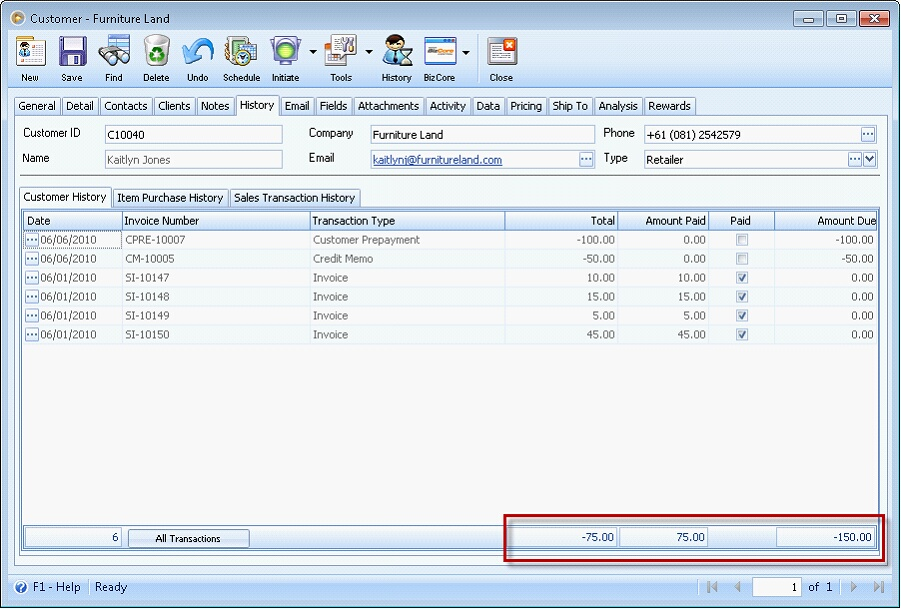

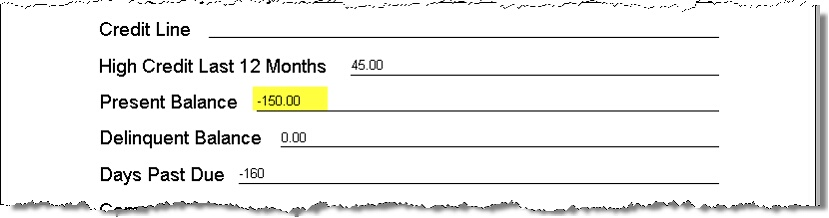

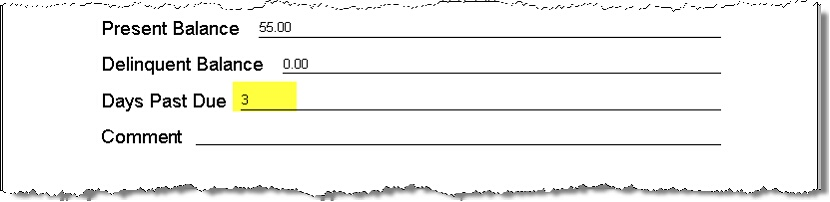

Present Balance – this field will use this formula: “Total Posted Invoices (including prepayments and credit memos) less Total Payments since printing the report”.

Example:

C10040 has Invoices, Credit Memo, and Prepayment with the total of -$75. The Total Payment since printing the report is equal to $75. Using the above formula, Present Balance is equal to -$150.

This is the amount that will be displayed on the report.

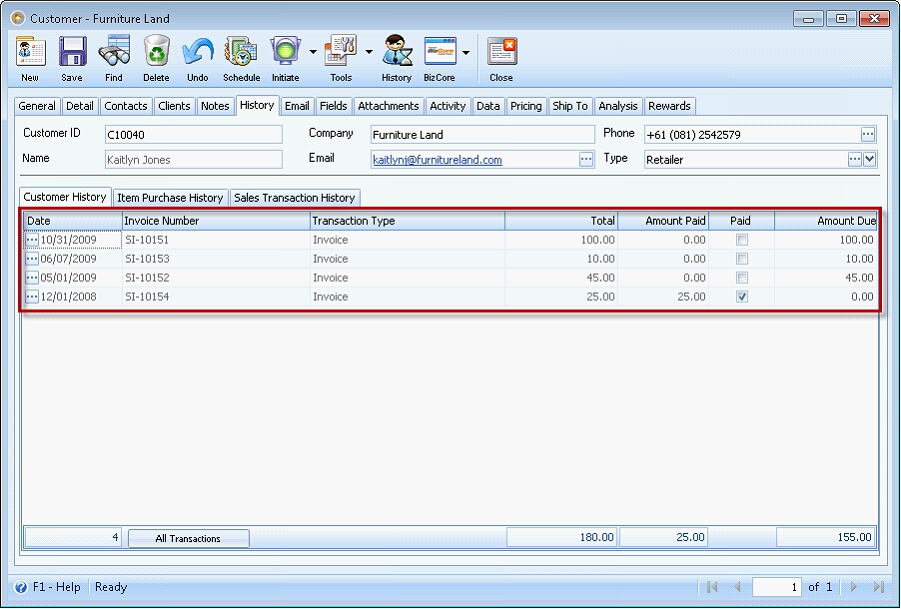

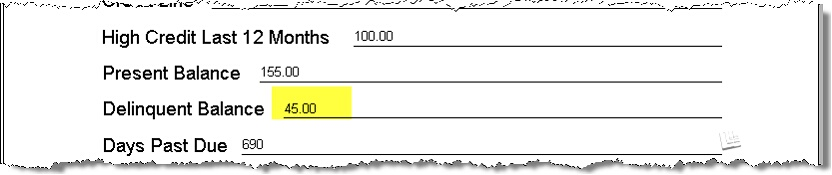

Delinquent Balance – This field will use this formula: “Total invoices that are still unpaid after 180 days from the terms due date since printing the report.

Example:

C00040 has 4 Invoices with the following setup.

SI-10151 with terms NET 30 is worth $100 remained unpaid for 3 days from invoice date.

SI-10152 with terms NET 30 is worth $45 remained unpaid for 200 days from invoice date.

SI-10153 with terms NET 15 is worth $10 remained unpaid for 150 days from invoice date.

SI-10154 with terms NET 30 is worth $25 is paid after 300 days from the invoice date.

The total Delinquent Balance is $45 because only SI-10152 has remained unpaid over 180 days. SI-10154 was unpaid for 300 days but it was paid already when the report is printed, the balance will not be considered as delinquent. SI-10151 is not included because it is not yet past due.

Days Past Due – the field will use this formula: “Total number of days to pay the overdue invoices”

For example, C10040 has 4 Invoices with the following setup:

SI-10146 with terms NET 30 is worth $10 is paid on the 30th day from the invoice date. It is past due by 0 days.

SI-10147 with terms NET 30 is worth $45 remained unpaid for 31 days from invoice date. It is past due by 1 day.

SI-10148 with terms NET 15 is worth $10 remained unpaid for 16 days from invoice date. It is past due by 1 day.

SI-10149 with terms NET 30 is worth $25 is paid after 31 days from the invoice date. It is past due by 1 day.

The total days past due is 3 days.

Comments – This is the space where you can manually write on the printout any additional comments for the customer.

Company – the company name in the Company Setup form.

Your Name and Title – Name and title of the customer.

Fax Number – the fax number found in the Company Setup form.

Phone Number – the phone number found in the Company Setup form.

Reference: Project 1135