Audit Adjustment after Fiscal Year is closed

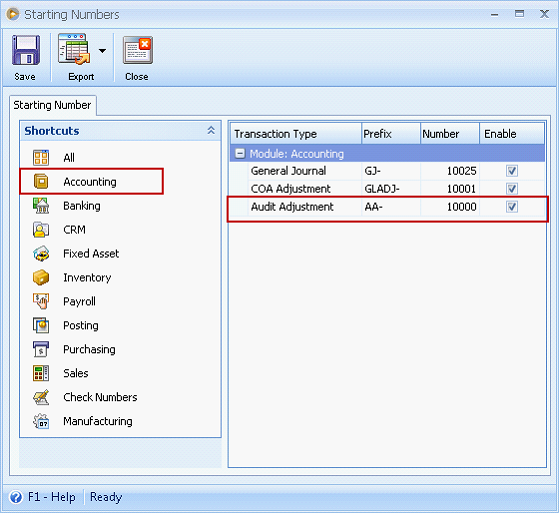

Audit Adjustment transaction can either be used when the fiscal year is still open or closed. This is just like a general journal transaction however the entries created here can either be included or excluded when printing reports, i.e. default reports or even financial reports. That is why it has its own starting number.

This documentation will show you how Audit Adjustment works when created after the fiscal year is closed.

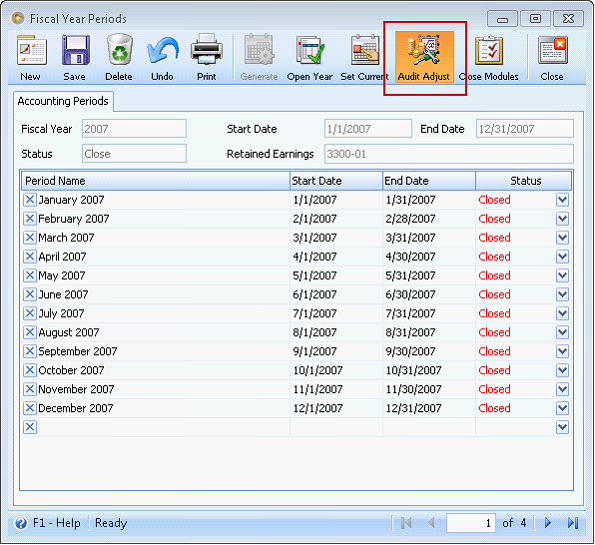

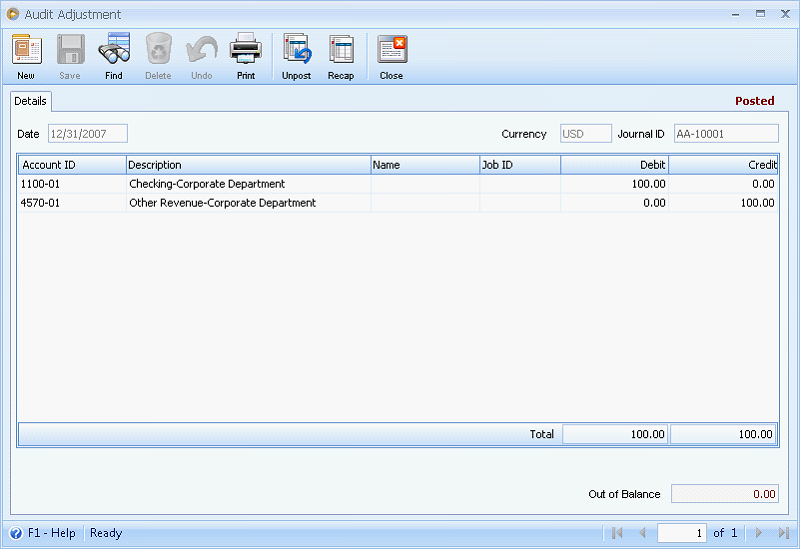

Say after the actual closing of fiscal year 2007, you have some adjustments that need to be done. You can use the Audit Adjustment form to do so. To open that form, click the Audit Adjustment button.

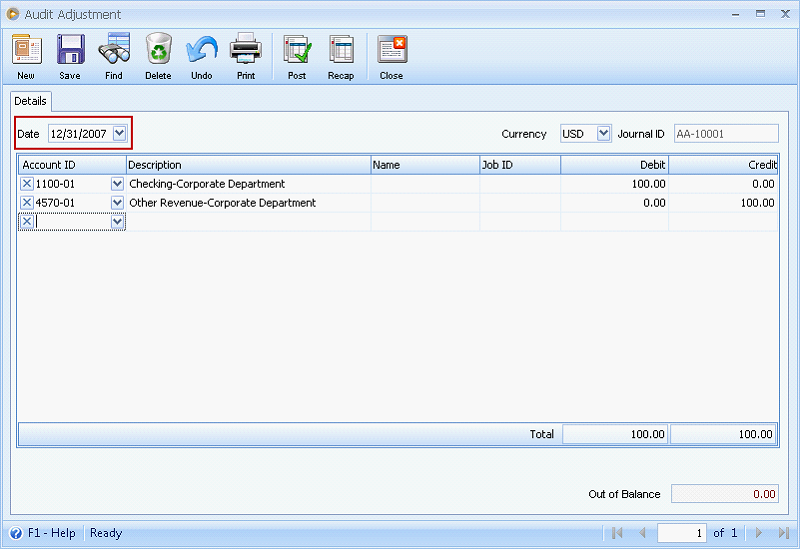

The Audit Adjustment form will be opened. When making this transaction, make sure the date is within the fiscal year you want the Audit Adjustment to take effect. In this example, since we are making adjustment for FY 2007, then 12/31/2007 is set on the Date field.

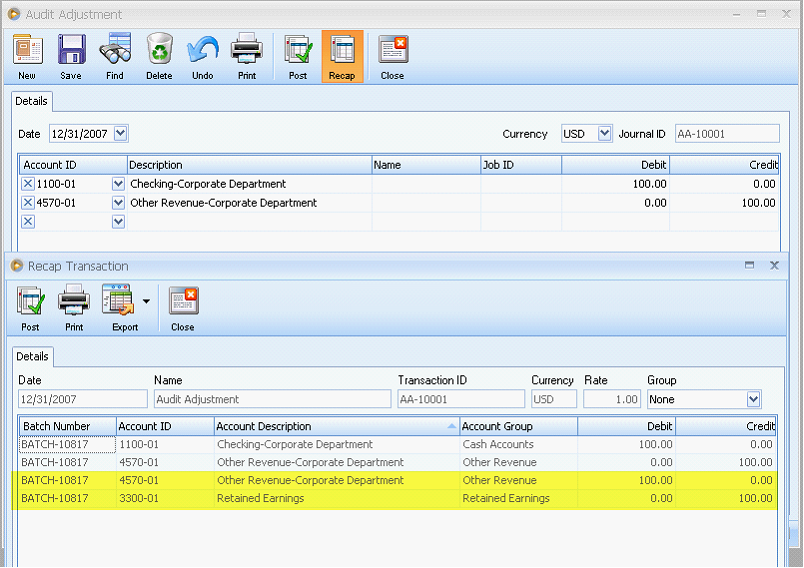

Clicking the Recap button on this form opens a Recap form that shows accounts affected by this transaction. An additional entry that zeroes out Revenue or Expense account, if there is, and a Retained Earnings entry to close that amount will be shown also (see highlighted accounts in the next screenshot).

Click Post button in the Recap Transaction form to actually post the Audit Adjustment transaction.

Printing reports

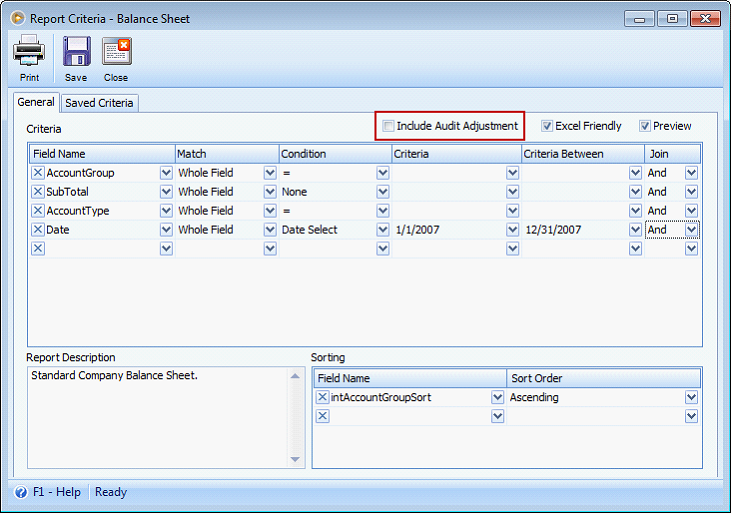

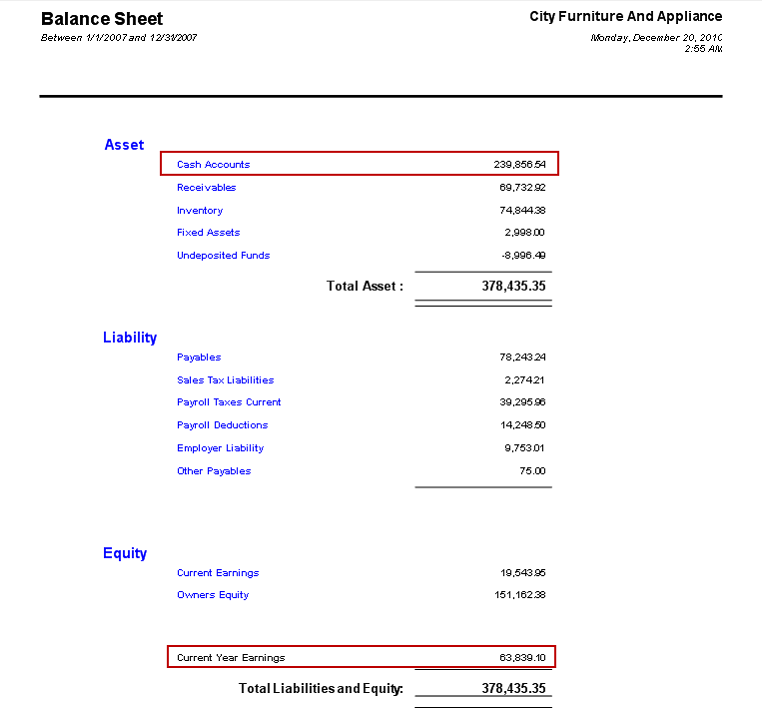

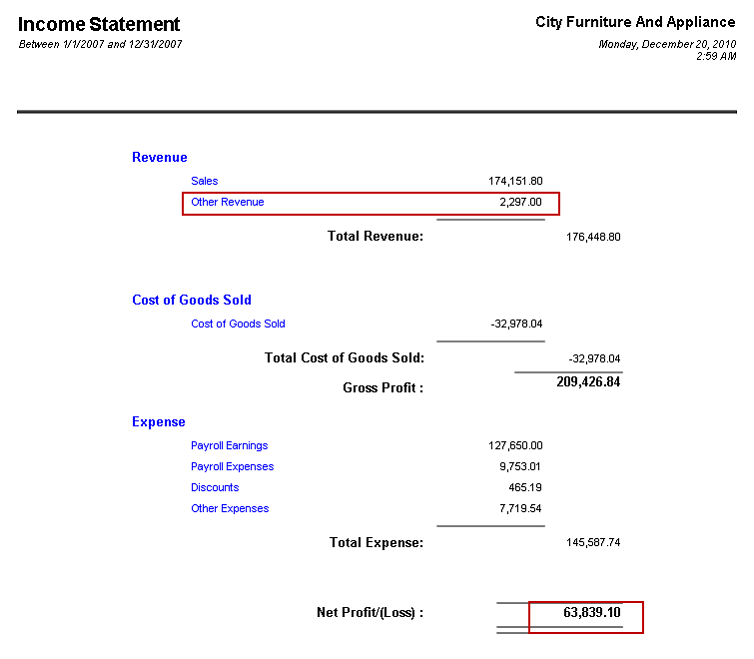

Include Audit Adjustment is unchecked

When this option is unchecked, audit adjustment created for the year will not be included in the reports.

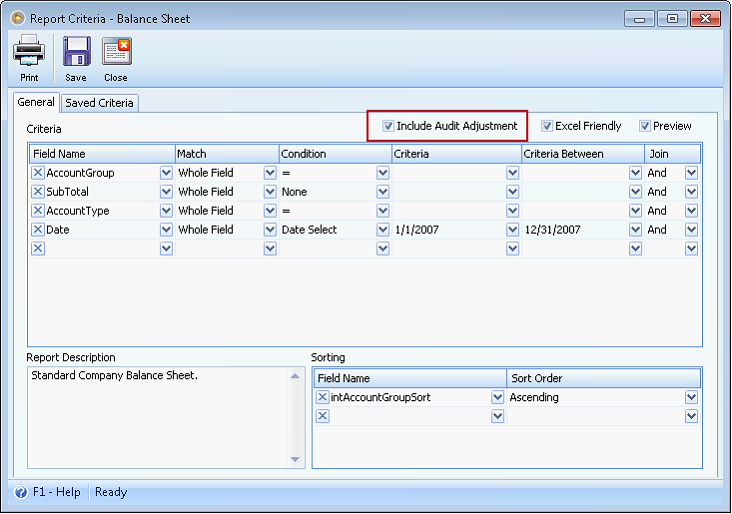

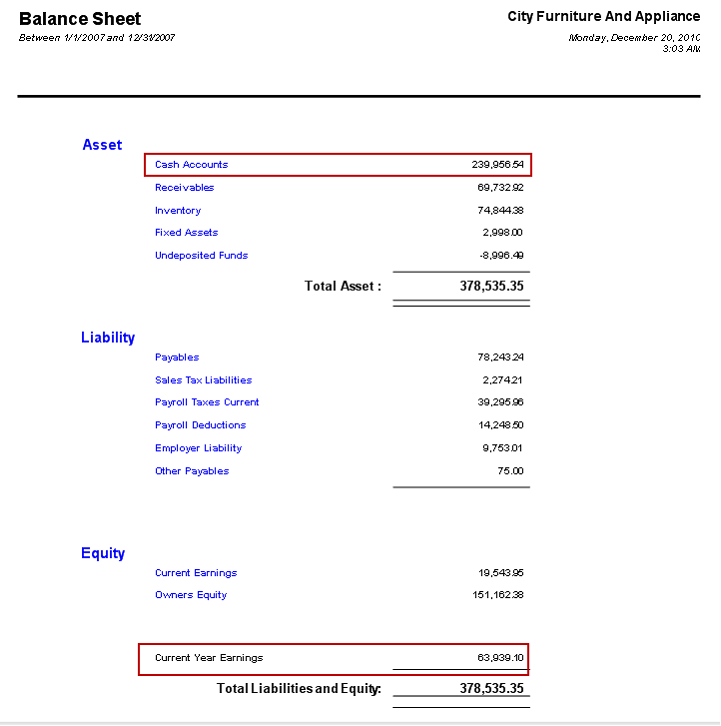

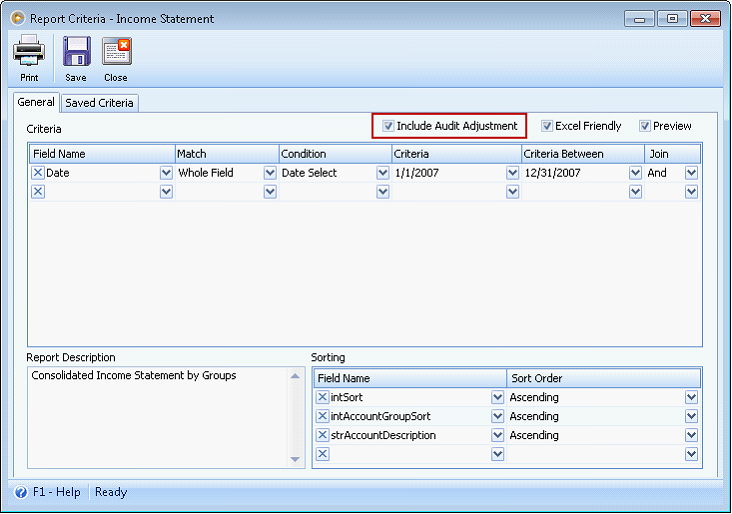

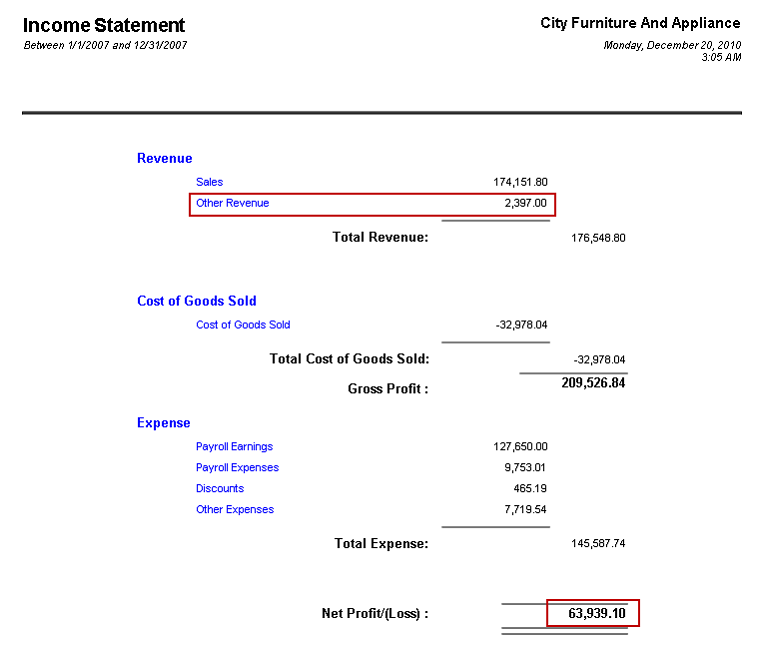

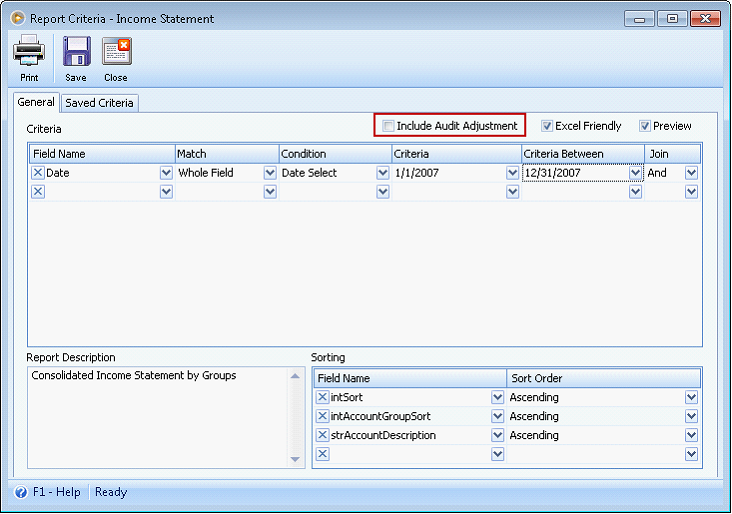

Include Audit Adjustment is checked

When this option is checked, audit adjustment created for the year will be included in the reports.