2011 FICA SS changes

For over 10 years until 2010, computation of FICA SS for employee and employer were always identical and always 6.2%. In 2011, the government changed this to where the Employee pays 4.2% and the Employer pays 6.2%. To cater this, Tax Tables and VisionCore codes were changed.

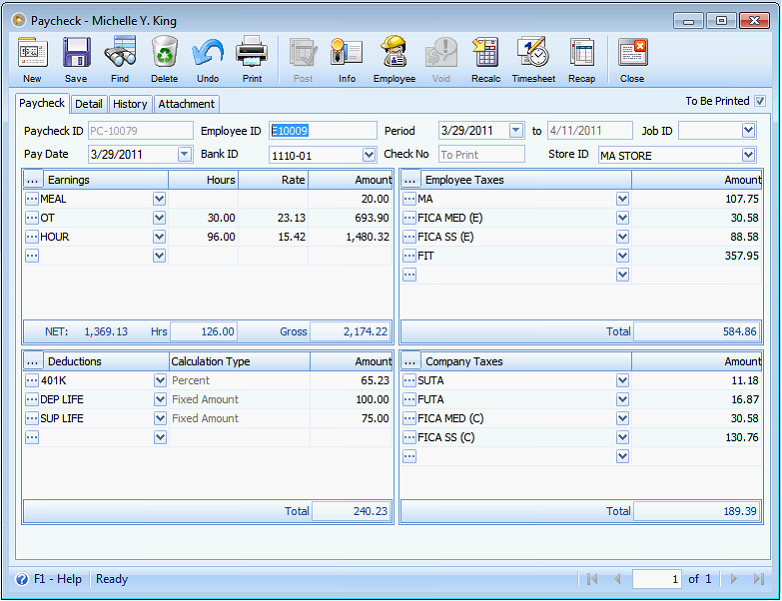

Paycheck Form

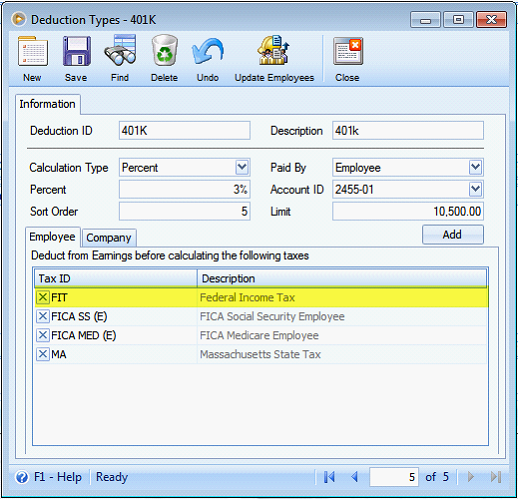

FICA SS taxes were computed using the Adjusted Gross. This means that if Deductions set have FIT, this should be deducted first from the Earnings.

Example:

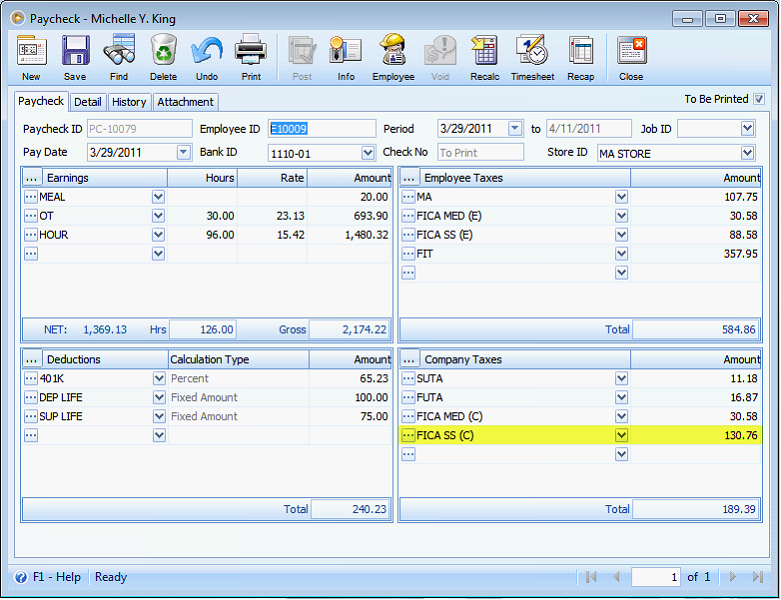

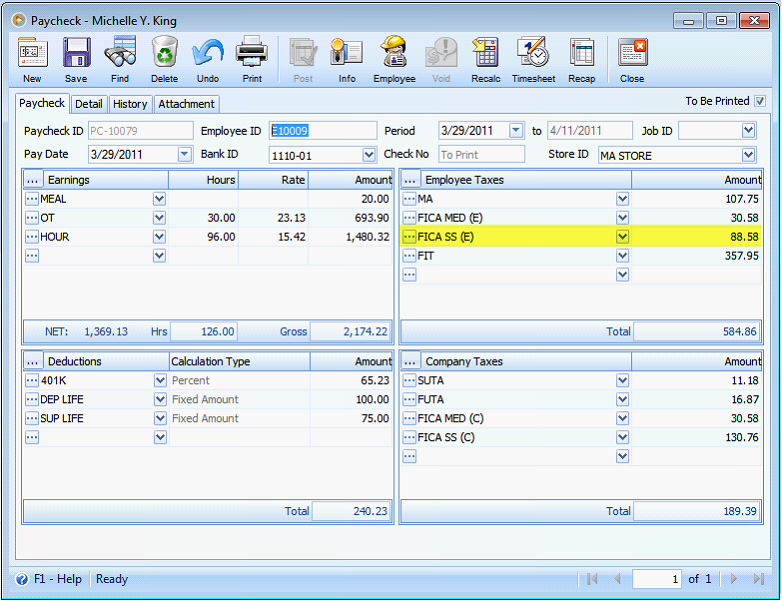

Below is an example of paycheck where new computation for FICA SS is applied.

One of the deduction, 401K, have FIT so this should be deducted first from the Gross amount. To get the Adjusted Gross, use this formula: Adjusted Gross = Gross – deduction with FIT (2,174.22 – 65.23 = 2,108.99)

To get the amount for FICA SS (C) tax for the above paycheck, use this formula: Adjusted Gross * 6.2% (2,108.99 * 6.2% =130.75738 or 130.76)

To get the amount for FICA SS (E) tax for the above paycheck, use this formula: Adjusted Gross * * 4.2% (2,108.99 * 4.2% = 88.57758 or 88.58)

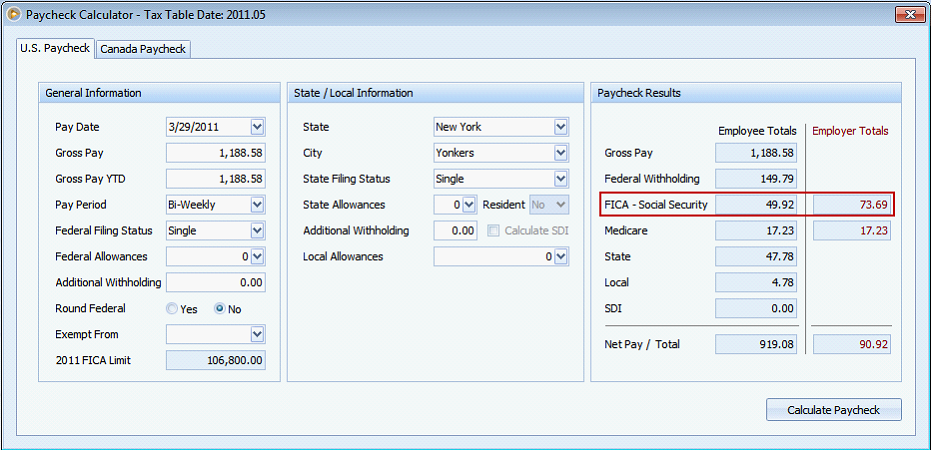

Paycheck Calculator Form

Changed in computation is also applied on Paycheck Calculator form > US Withholding tab.

Same computation is used to get FICA SS tax amounts.

•For FICA SS (E), Gross pay * 4.2% (1,188.58 * 4.2% = 49.92036 or 49.92)

•For FICA SS (C), Gross pay * 6.2% (1,188.58 * 6.2% = 73.69196 or 73.69)

Reference: Task 1272