1099 MISC Options and 1099 Detail Report

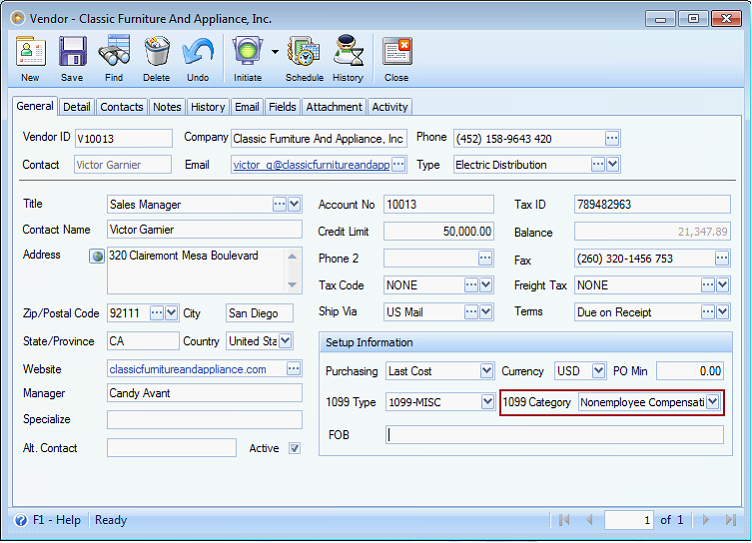

Users are now able to assign 1099 Category for 1099 Vendors. To cater this, 1099 Category field is added on Vendors form > General tab. This is enabled only if 1099 Type is set to 1099-MISC.

When enabled, this is defaulted to Nonemployee Compensation.

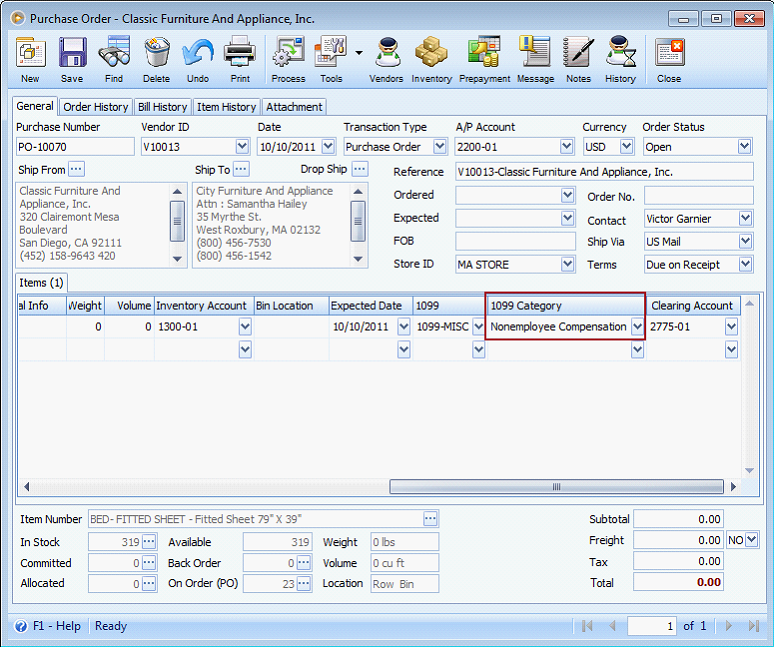

The same field is added on all the Purchasing forms such as Purchase Order, Purchase Receipt, Return-to-Vendor, Bills, Debit Memo, and Vendor 1099 Opening Balance, which automatically display the 1099 category set on the Vendor form.

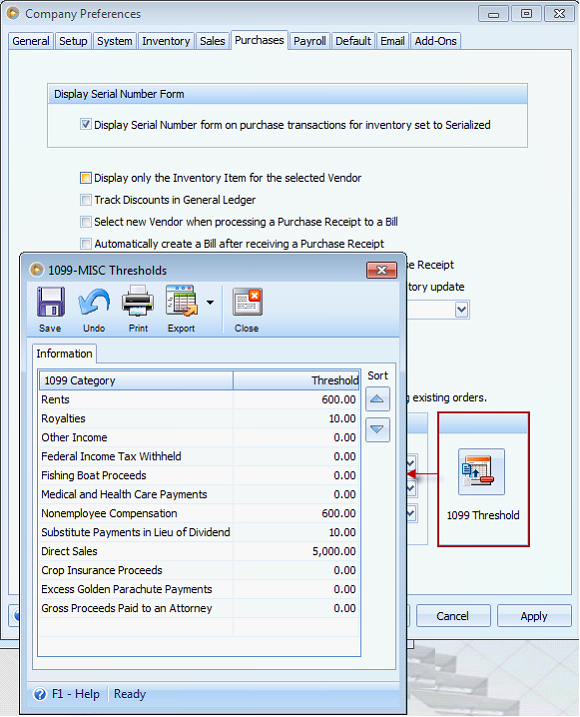

The 1099 category list includes all the 1099-MISC Threshold displayed on Company Preference > Purchasing > 1099 Threshold.

Form 1099-MISC Report

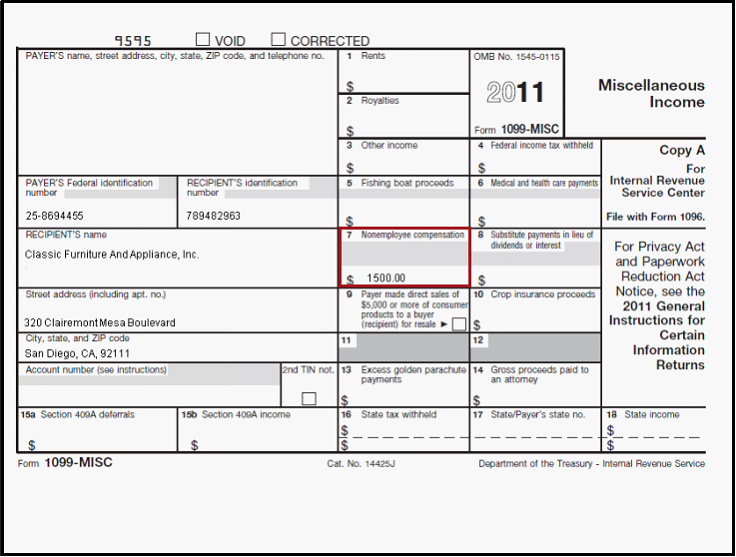

Form 1099-MISC report can be found under Accounts Payable group. When printing this report, associate 1099-MISC amounts should be displayed in their appropriate boxes.

•Box 1 – Rents

•Box 2 – Royalties

•Box 3 – Other Income

•Box 4 – Federal Income Tax

•Box 5 – Fishing Boats Proceeds

•Box 6 – Medical and Health Care Payments

•Box 7 – Nonemployee Compensation

•Box 8 – Substitute Payments in lieu of Dividends or Interest

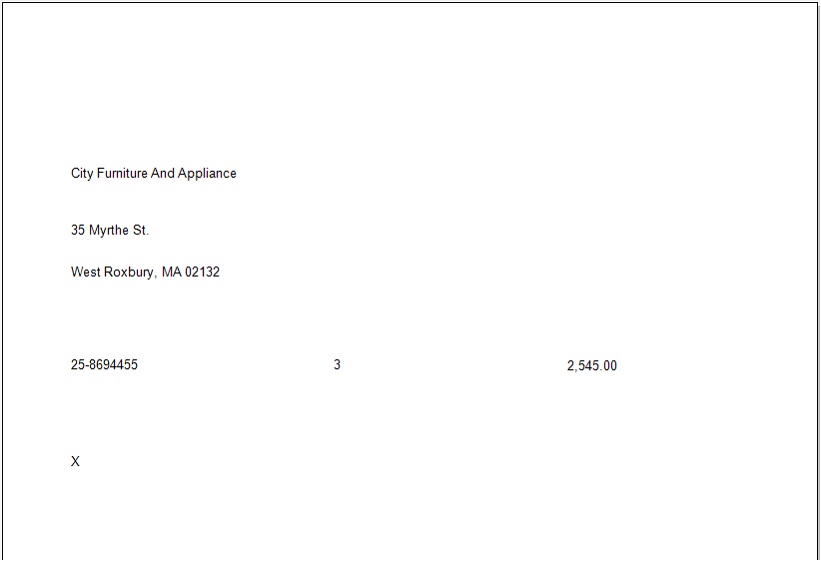

•Box 9 – Direct Sales. Amount of Direct Sales will not be displayed. Instead, an ‘X’ will be entered on the checkbox for sales equal or higher that the threshold.

•Box 10 – Crop Insurance Proceeds

•Box 13 – Excess Golden Parachute Payments

•Box 14 – Gross Proceeds Paid to an Attorney

![]() Note that the values on the threshold must follow the latest instruction for 1099-MISC for year 2011. You can follow this link for more information: http://www.irs.gov/pub/irs-pdf/i1099msc.pdfhttp://www.irs.gov/pub/irs-pdf/i1099msc.pdf

Note that the values on the threshold must follow the latest instruction for 1099-MISC for year 2011. You can follow this link for more information: http://www.irs.gov/pub/irs-pdf/i1099msc.pdfhttp://www.irs.gov/pub/irs-pdf/i1099msc.pdf

Example:

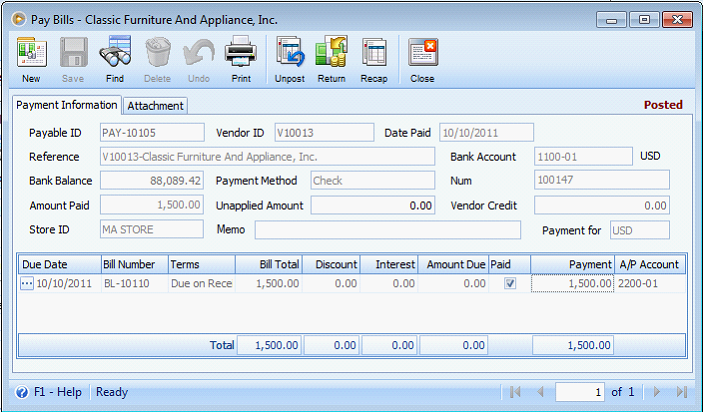

Using V10013 above which has a 1099 Category of Nonemployee Compensation, create a payable.

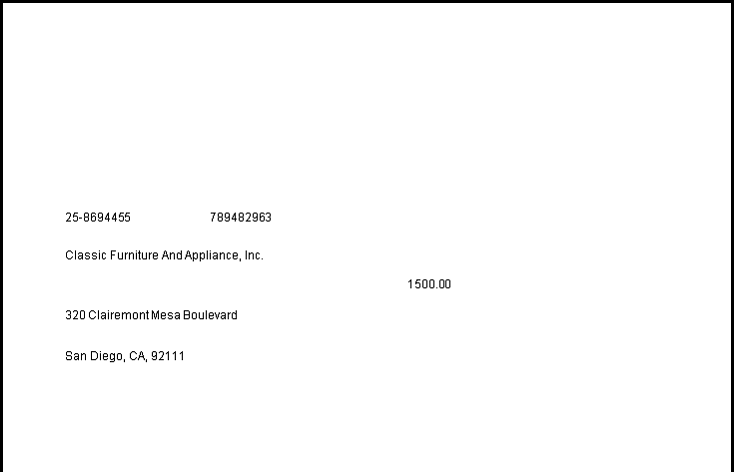

This is how it is printed on VisionCore.

When printed on a pre-printed 1099-MISC form provided by the IRS, this is how it looks like. Amount is displayed on box 7.

Form 1096

Located under Accounts Payable group, Form 1096 report is used as a cover sheet that is attached to Form 1099 being sent to the IRS. It displays the total number of records and the total amount of transaction of the selected 1099 Type.

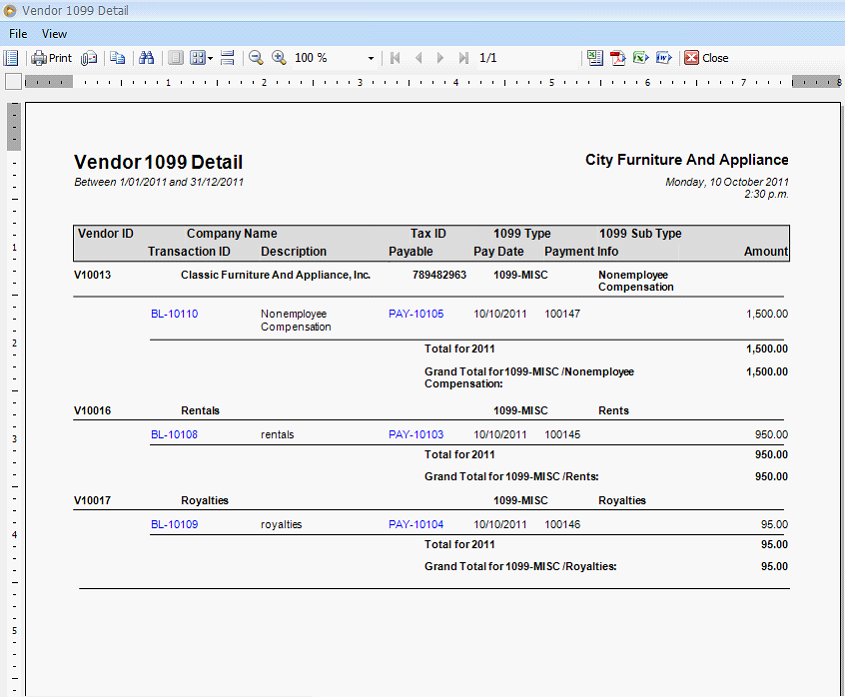

Vendor 1099 Detail

Vendor 1099 Detail report is a newly added report to shows what makes up the number printed on Form 1099-MISC report and Form 1096 report. This is located under Contact Manager report group.

Task: 3757